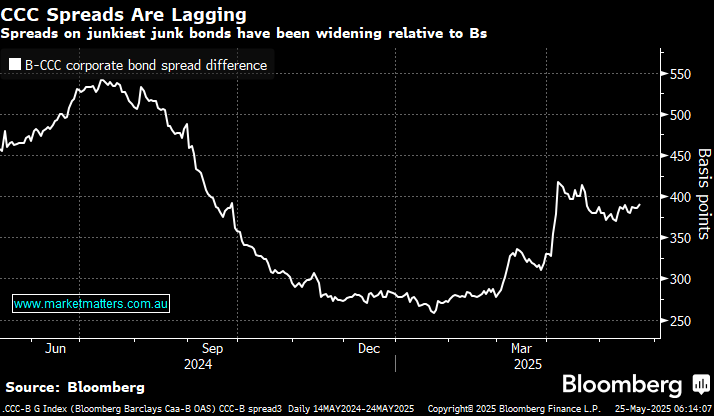

Sentiment is slowly becoming more cautious across bond markets, with the lowest rung of junk bonds flashing warnings that the US economy could soon face slower growth, higher inflation, and the possibility of a recession. This is precisely why investors are hoping for rate cuts from the Fed. For much of the year, money managers had embraced optimism and hoovered corporate bonds, sending valuations to increasingly more expensive levels, but now Wall Street is starting to focus on how bad things can get. Importantly, it doesn’t mean things will go pear-shaped, but Jamie Dimon, CEO of JPMorgan, believes credit markets haven’t been building in enough risk.

- Risk premiums on lower quality junk bonds have widened 1.56 percentage points this year, and 0.4 percentage point in the latest week.

However, investors are still buying at least some junk bonds. CoreWeave Inc., an AI cloud hosting firm, sold $2 billion of five-year notes on Wednesday, finding enough demand to boost the offering from $1.5 billion. In the US investment-grade market, companies sold more than $35 billion of bonds this week, topping expectations of around $25 billion. Equity markets need healthy bond markets on all levels to flourish, and while yields have increased, and some risk spreads have widened, they are not to the point where we should be concerned.

- At this stage, we are cognisant that bond markets are slowly forming a headwind for stocks, but we believe stocks have enough good news to propel them higher through 2025.