Hi Scott,

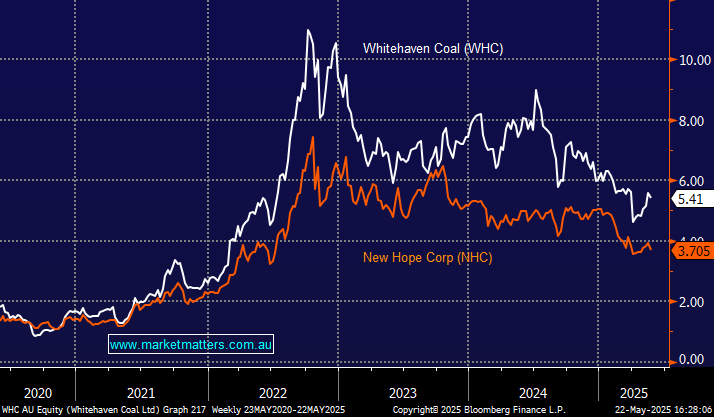

Short answer is Whitehaven Coal (WHC) that we own in our Active Growth Portfolio, but we do also hold NHC in our Active Income Portfolio.

The answer comes by looking forward as opposed to the present, plus of course we assume coal prices at least hold around their current, already depressed levels:

- NHC is forecast to yield ~11% over the coming years from its primarily thermal coal operations, with the company paying out about 85% of its earnings as dividends.

- WHC is currently expected to yield ~4.6% over the coming year from its primarily metallurgical coal operation, paying out ~45% of earnings as dividends, though we think WHC will grow earnings and thus dividends at a greater clip in coming years due to their recent acquisitions. We will find out more about future capital management at their FY25 result in August.

In short, WHC is more leveraged to a coal price uptick, making it a higher risk/higher reward, while NHC is investing less, giving more back to shareholders, making it lower risk/lower potential upside. A close call, but WHC gets the nod.