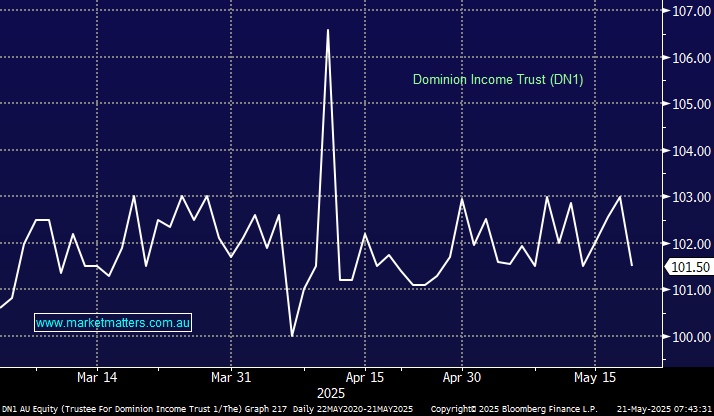

DN1 listed in early March at $100 and has traded between $100 & $106.50 since. There is no reason for this security to rally ~6.5% other than a fat finger/aggressive execution, though we now revisit the Income Trust as a potential inclusion for the Income Portfolio. Dominion is a brand of Realm, a locally based Credit and Fixed Income manager with ~$7.4bn under management. They have a long history focussing on Residential Mortgage-Backed Securities (RMBS), though they invest right across the credit space. The interesting aspect of this security is it has a fixed term to maturity (6 years) with an optional call date at year 5 – much like a hybrid. Dominion say they’ll call it at the 5-year mark which implies redemption in March 2030. This creates an added level of safety, and reason for the note not to trade below NTA.

As a refresher, DN1 targets a floating rate of return with a 3.5% margin over the bank bill swap rate, which is ~7%. This is in line with median hybrid margins over time, however in recent times, hybrids have tightened and now trade in the low 2’s (over swap). This makes DN1 attractive in our view even though rates will likely track lower.

That said, there are several points worth highlighting;

- The 3.5% margin over BBSW is targeted, not set like a hybrid, and it’s in excess of the 1-month BBSW given the trust pays monthly distributions (not 3-month BBSW like a hybrid). After yesterday’s rate cut, the 1-month BBSW is 3.76% + 3.5% margin = 7.26%.

- Distributions are all cash, with no franking. Hybrids are franked (with the margin quoted inclusive of franking).

- The trust will invest in a globally diversified portfolio of credit exposures across government, bonds, corporate bonds and structured credit (including public and private debt) with a target average credit rating of BBB.

- Banks (and therefore hybrids) are exposed to credit cycles and what’s playing out economically, and while that’s also true for the Trust, the underlying exposures are different as outlined above.

- The BBB target is aligned with major bank Hybrid ratings (which are also BBB), which implies they are both low risk; however, for the Trust, it’s a target average credit rating across the book.

- History has shown that listed investment trusts (LIT’s) can trade at a discount to their Net Asset Value (NAV) on the ASX, not possible with a Hybrid, and this has been an issue for the structure.

- However, no LIT’s have had a fixed term whereby, investors will be able to get the NAV at maturity if it’s not being offered by the market. This should address that issue in MM’s view.

- The Trust is paying a higher return than hybrids are currently offering.

The Trust structure of the security is an innovative one, whereby they invest it in a credit note that pays 1m BBSW + a 4.00% margin, the note invests in an underlying portfolio at a 4% margin, they charge a 50bps fee and pass through the 3.5% targeted margin net of fees to the LIT. NTA at the end of April was $100.21.