Resources are getting some early Christmas cheer! (OZL, WPL, FMG, IGO, NCM)

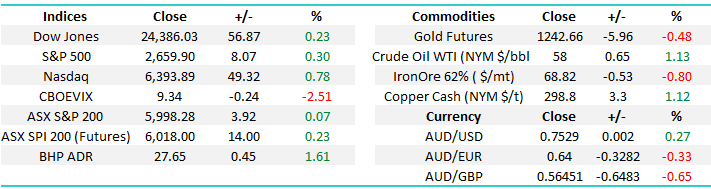

The ASX200 has received a few leads over recent sessions to commence a Christmas rally but continues to ignore them as closing above the psychological 6000 area remains a stubborn hurdle. However as every day ticks away we are getting closer to the strongest seasonal fortnight of the year. This morning the overnight futures are pointing to the market opening up ~15-points but we believe the resources may take us higher e.g. BHP is trading up 45c / 1.6% in the US.

The view of MM remains intact with a 6125 target to say goodbye to 2017, or a 8.1% return for the year not including dividends.

Today we are going to focus on resources following our recent purchases of Fortescue (FMG) and OZ Minerals (OZL), plus our previous existing holdings in Woodside Petroleum (WPL), Newcrest Mining (NCM) and Independence Group (IGO).

ASX200 Daily Chart

The Resources Sector

Australian resources stocks have enjoyed a stellar 2-years with BHP advancing almost 100% however investors would be wearing blinkers if they did not recognise their relative poor performance since the GFC with BHP still down 40% from 2008 levels compared to CBA which is up 30%, plus having paid significantly greater dividends.

At MM we firmly believe that resource stocks are shorter-term investing vehicles simply because they cannot accurately forecast / predict their profitability years in advance as its highly dependent on the respective underlying commodity prices which is driven by the ebbs and flows of economic trends and importantly the miners reactions (in terms of supply) to those trends. Two factors maintain our caution towards these stocks over the medium-term, at least for now:

- The Bloomberg Commodity Index remains firmly in a 7-year downtrend.

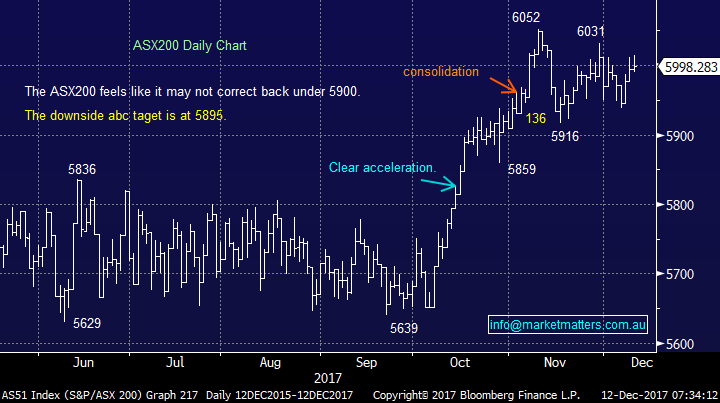

- The highly correlated $A has generated excellent sell signals targeting the 65c area, or ~13% lower.

Overall we’ve enjoyed some great success in this sector by adopting a more active but patient approach. We certainly feel no obligation to hold resource stocks in the Growth Portfolio as was demonstrated for the first few years of our inception when BHP more than halved.

Bloomberg Commodity Index Monthly Chart

Australian Dollar $A Monthly Chart

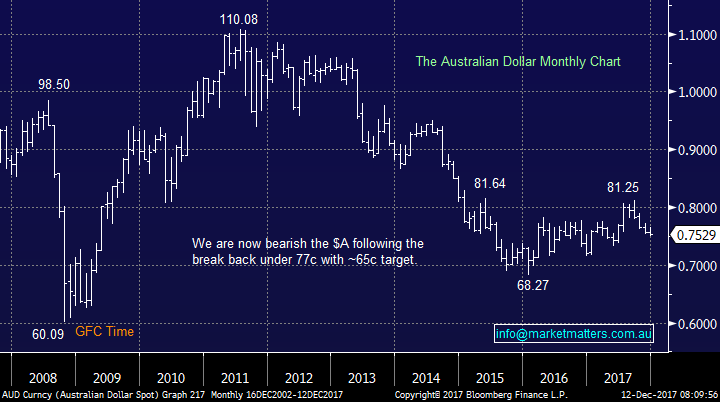

In the short-term the Bloomberg base metals spot index has corrected ~7% enabling us to buy OZ Minerals (OZL) under $8. Ideally we will now see a rally to fresh 2017 highs unfold from this index.

Bloomberg Base Metals Index Weekly Chart

1 OZ Minerals (OZL) $8.07

We are happy with our trade location under $8 with a current target ~$9.

OZ Minerals (OZL) Daily Chart

2 Fortescue Metals (FMG) $4.61

We are happy with our trade location at $4.60, especially while strong $4.50 support holds firm. We are at least targeting a “pop” back over $5.

Fortescue Metals (FMG) Weekly Chart

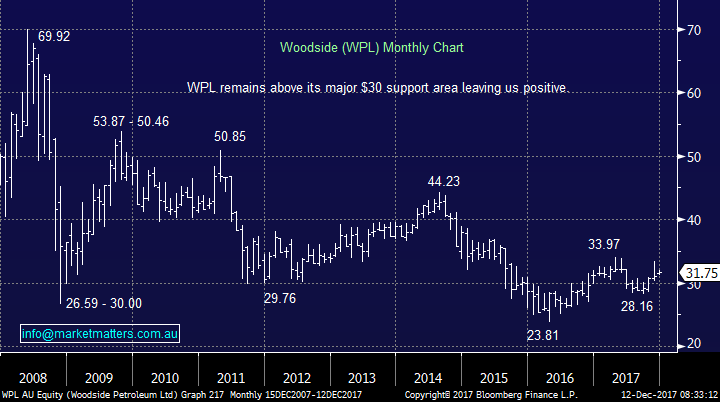

3 Woodside Petroleum (WPL) $31.75

Again we are happy with our trade location at $31.29 following the Shell placement. We are targeting a minimum rally back over $34 which may be assisted by some Christmas “window dressing” especially considering most fund managers are now very long WPL.

Woodside Petroleum (WPL) Monthly Chart

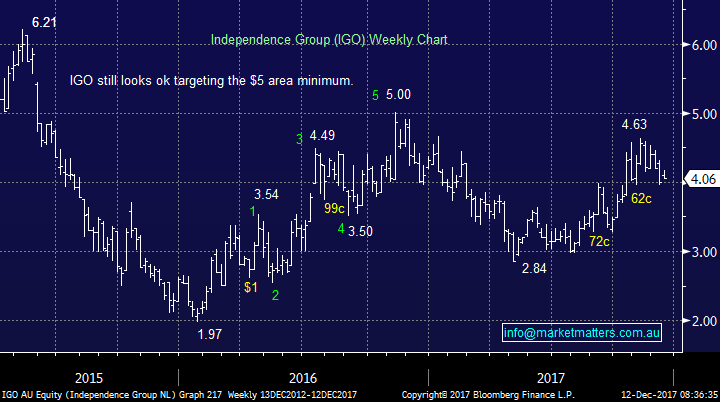

4 Independence Group (IGO) $4.06

In hindsight we should have been more active with this gold / nickel miner IGO having watched a 8.4% paper profit become a 4.9% paper loss. We remain bullish targeting ~$5.

Independence Group (IGO) Weekly Chart

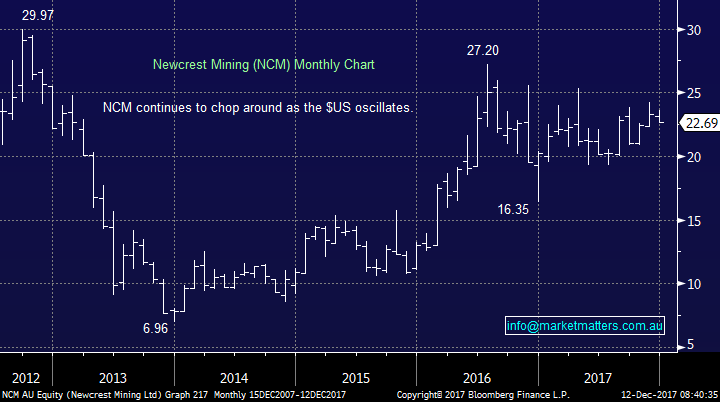

5 Newcrest Mining (NCM) $22.69

We are slightly uncomfortable with our NCM position because we are bullish global interest rates, not an ideal backdrop.

MM is keeping a close eye on this holding and may simply cut it.

Newcrest Mining (NCM) Monthly Chart

Global markets

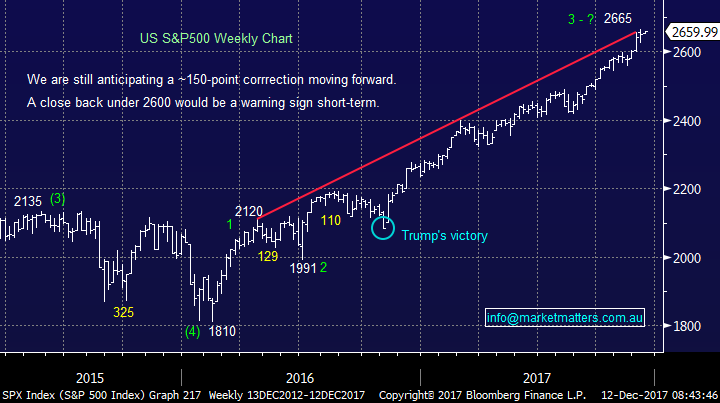

US Stocks

No change, we still need a ~5% correction to provide a decent risk / reward buying opportunity, no sell signals have been generated to-date but it’s struggling slightly above 2650.

The feeling is traders are going short and then getting caught as the market fails to correct.

The current strong rally since Donald Trump’s election adds to our confidence with buying a decent ~5% pullback.

US S&P500 Weekly Chart

European Stocks

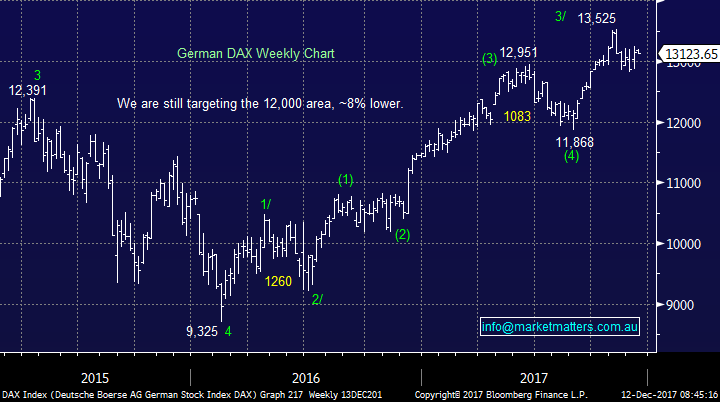

European stocks look to be failing after their recent break out to fresh 2017 highs, we remain neutral / negative Europe over the next few weeks.

German DAX Weekly Chart

Conclusion (s)

We are overall comfortable with our 5 holdings within the resources space i.e. a hefty 21.5% of the MM Growth Portfolio.

At this stage we plan to sell all / most of these holdings into January strength, especially if we see fresh highs from the Bloomberg base metals index.

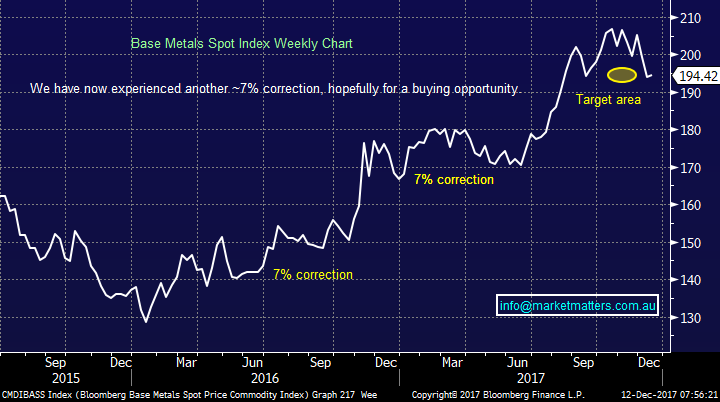

Overnight Market Matters Wrap

· The US share markets closed higher overnight, advancing from earlier losses ignited from a small explosion marked as a terrorist attack.

· Investors focused back on its key interest rates along with the strength of the energy sector after crude oil was up 1.13%.

· BHP is expected to outperform the broader market, after closing in the US up an equivalent of 1.61% to $27.65 from Australia’s previous close, ignoring a 0.8% decline in Iron Ore.

· The banks and insurers are expected to be under the spotlight today, with dividends set to be paid this week and ANZ selling its life insurance arm for $2.85b – a reasonable outcome.

· The December SPI Futures is indicating the ASX 200 to open 17 points higher, testing the 5715 level this morning.

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 12/12/2017. 8.00 AM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here