DDR is a rare beast, set to deliver solid growth (sales +10% last quarter), an attractive fully franked dividend yield (5.8%), while trading on an okay valuation (19x) after a reasonably tough period. Dicker Data is the largest IT distributor in the Corporate, Commercial, and Enterprise market in Australia, with the same themes driving outperformance at JB Hi-Fi (JBH) relevant for DDR. i.e. as businesses refresh technology to take advantage of developments in AI – this is the medium-term story.

While they posted a softer result than they would have liked in February, with revenue growth of +3%, which translated into flat earnings, the backdrop for SME has been very challenging, and this accounts for 80% of DDR’s sales. If we do experience a better operating environment for small businesses in Australia, with rates coming down, AI driving efficiency, and a refreshed government focusing on productivity (probably wishful thinking), then the backdrop for business could start to look better. At this stage, DDR are expected to grow earnings 10% a year over the next 3-years with the dividend reflecting a similar increase, which would be a solid outcome.

More broadly, we discussed the composition of the Income Portfolio a few weeks ago (here) in a note titled “Defensive positioning has worked—now what?” The conclusion was that tilting the portfolio mildly towards cyclical and reducing defensives after such outperformance made sense – DDR fits into the cyclical bucket.

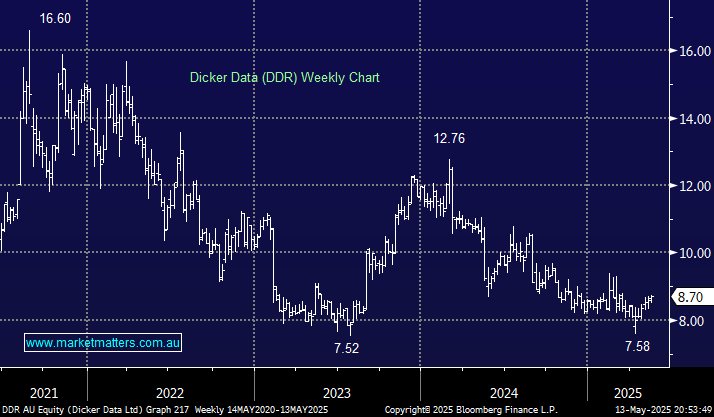

- We are adding DDR to the Hitlist for the Income Portfolio, with the risk/reward looking attractive below $9