Hi Chrstof,

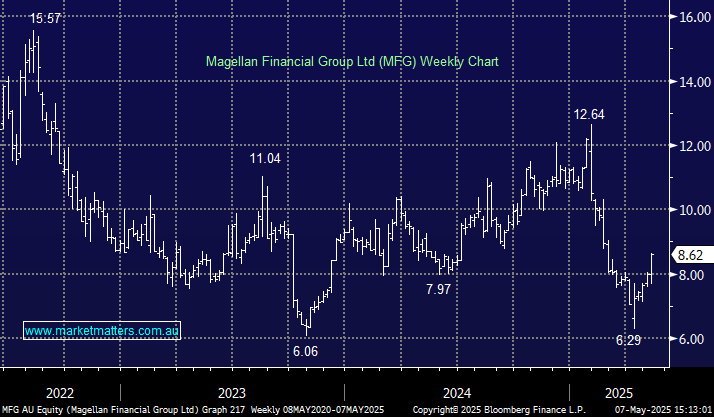

MFG provided a FUM update on Wednesday, and the market liked what it saw, hopefully the below is clearer:

- MFG reported April Funds Under Management (FUM) of $38.5bn up from $37.5bn, which included $1.4bn from Vinva after MFG became the Responsible Entity (RE) of the Alpha Extension Fund – In other words if you took out the $1.4bn FUM went backwards to $37.1bn.

- However, with $1.0bn of net outflows the update implied solid performance for the month, particularly given US stocks underperformed Australian stocks by 4% in April and the AUD was up 2.7% – i.e. FUM increased $600mn net of outflows and Vinva.

- The other aspect here is the further integration of Vinva operations in the MFG business, which is a positive, and the price they paid for Vinva is not relevant when we just focussing on FUM.

Fund managers live & die on performance because it drives FUM (which drives earnings).

- MFG is trading on an Est. 10x for FY25, but if we strip out their cash and principal investments, they are trading closer to 7-8x. We often use the metric of FUM vs market cap in looking at fund managers, and MFG trades on around 3% of FUM which is very low. If they get performance right, and they start to grow FUM again, this will look incredibly cheap in time, and we’re getting a 7% dividend yield while we wait.

- Further, we like their newish strategy of building out multiple brands, running uncorrelated strategies, similar to something like a Pinnacle (PNI) which trades on 28x. This reduces the reliance on one strategy, or one stock picker (as was the case in the past) to get things right, thus creating a more robust earnings profile.

We own MFG in our Active Income Portfolio for yield (and some growth) and the position looks good after this week’s update.