Gold goliath NEM, the recent acquirer of ASX-listed Newcrest, retreated 2.5% overnight. However, the stock was trading up ~1% in late trade following a solid Q1 earnings beat:

- 1Q revenue of $5.01bn was a beat of the $4.75bn estimate.

- 1Q EPS of $1.25 was a beat of the 0.90c estimate.

- Average realised gold price was $US2,944, up from $US301 in the previous quarter.

- 1Q free cash flow of $1.2bn enabled a 25c dividend to be declared.

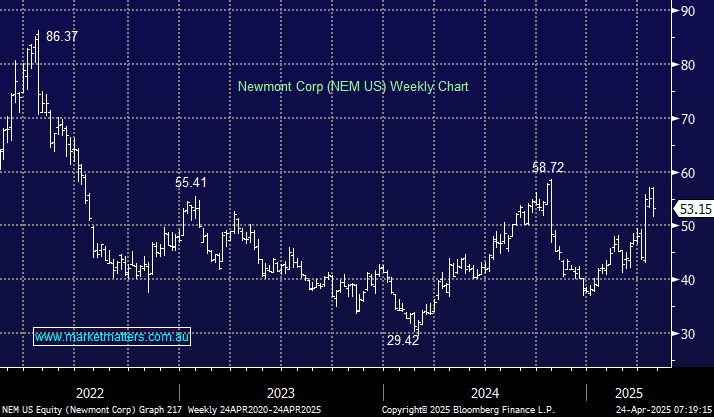

This solid set of numbers makes NEM a definite candidate for MM to increase our international gold exposure into weakness – we like to buy the companies that are delivering but dragged lower by a weak market/sector.

- We can see the NEM testing $US50, or 6% lower, in the coming weeks.

This morning, we have briefly updated our views toward four well-known ASX-listed gold names as we “stalk” purchases for the coming months.