BHP and RIO are potentially conflicting with our market view

Yesterday the ASX200 rallied for its 5th consecutive day, making fresh decade highs and this morning the US has “yet again” rallied to fresh all-time highs. Both locally and overseas, the banks / financials are coming back into favour as US bond yields continue to rise, and considering this sector comprises ~40% of the ASX200 its hard to imagine a meaningful market decline until this theme has run its course.

Higher interest rates was one of our strongest opinions for both 2017 and 2018 forming the key reason why we currently have no interest in holding “yield play” style stocks. However until global equity markets show signs of being concerned with rising interest rates, as opposed to embracing them as a sign of economic strength, our call for a short term pullback may be too early. Locally, the ASX 200 is showing signs of fatigue however with the strength of buying in the financial sector overseas, and the clear tailwinds in the commodity markets right now, the ASX is once again being dragged higher by overseas strength. As we cautioned early in the week, bull markets have a tendency to run harder than seems plausible as the time. For now, our call for a short term pullback for stocks is on ice – sort of like a good champagne!

The standout mover domestically as the second week of 2018 unfolds has been the resources sector with over the last 5-days alone BHP +4.7%, RIO +4.4% and Fortescue (FMG) +7.7%. Unfortunately we clearly took profits too early in late December on our positions within the sector. The question we ask ourselves now is “are we wrong and a decent pullback to again establish a resources exposure may not be imminent?” At Market Matters we have no issues selling a touch early, but it’s a different matter if we’ve got off a train that’s just commenced its journey, hence investors should continually question their actions and thought process, just as we do.

The below quote may be more appropriate for Bitcoin than BHP today:

“Fortunes are made by buying low and selling too soon.“ – Baron Rothschild

If we are wrong and the resources are set to advance strongly in coming months, then we clearly need to consider how / when to re-enter the sector.

ASX200 Daily Chart

Before we look at BHP and RIO in detail, let’s briefly consider some of the underlying factors influencing our resources sector.

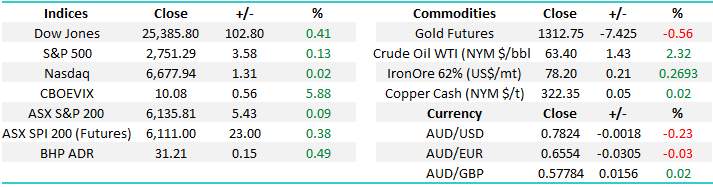

1 The overall commodities market looks strong and Market Matters has a minimum target of ~7% higher.

Commodities CRB Index Quarterly Chart

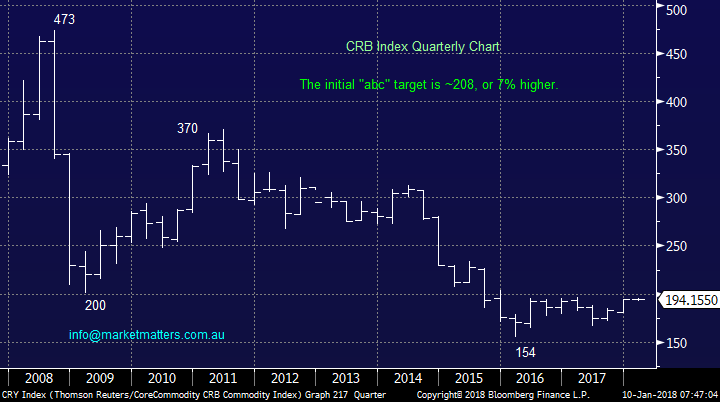

2 We’ve been bullish crude oil for a while, hence our very healthy position in Woodside Petroleum (WPL) which has rallied almost 10% over the last month.

Market Matters’ target for crude oil remains the $US70/barrel area, or 11% higher.

Crude Oil Monthly Chart

3 The important bulk commodity for Australia, Iron ore, is a bit more 50-50 to us at current levels as it challenges its highs for 2017. The Australian government has forecast a fall of 20% this year which probably guarantees it goes up! However on a more serious note, we are neutral at current levels.

Iron Ore Future Monthly Chart

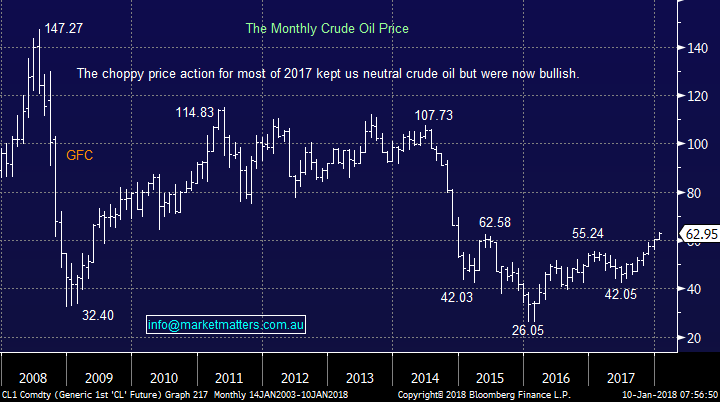

Base metals continue to look strong but we can easily see a 5% pullback in the coming months for a better buying opportunity – very similar to what occurred in 2017 which still unfolded as a strong year.

Bloomberg Base Metals Index Monthly Chart

Lastly, looking at the highly correlated Emerging markets (EEM) which have a similar appearance to the based metals index. We are still bullish but as they test their 2011 highs we believe the prudent course of action from a risk / reward perspective is to aim to buy the ~45 area i.e. the December lows until the picture evolves further.

Emerging Markets ETF Monthly Chart

Moving onto more stock specifics and particularly BHP and RIO, which unusually is where we see more value in the resources end of town.

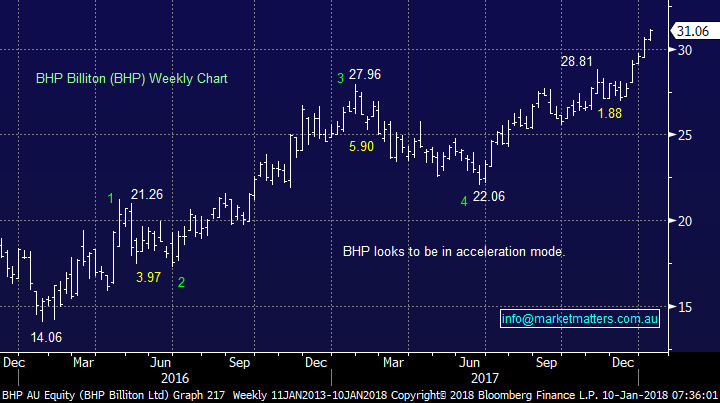

BHP Billiton $31.06

At Market Matters, we like BHP but having bought the $5 pullback in 2017 we unfortunately took profit too early in anticipation of a deeper correction than the $1.88 which unfolded.

BHP is not expensive relative to the market and an anticipated ~5% fully franked yield is potentially nice icing on the cake for investors.

We expect to buy BHP in the coming weeks / months – perhaps in 2 tranches.

BHP Billiton (BHP) Weekly Chart

RIO Tinto (RIO) $79.87

RIO looks extremely similar to BHP, but its large dependency on iron ore has us less excited than with BHP.

We may buy RIO in coming weeks / months, but it’s likely to be a smaller position than with BHP.

RIO Tinto (RIO) Weekly Chart

Conclusion

We like the resources sector for 2018 and especially BHP, however we are very mindful of the dangerous human emotion of FOMO (Fear of missing out) which regularly leads to poor investment decisions / location for many people.

We expect to buy BHP and potentially RIO in 2018, but are looking for optimum entry levels on a risk / reward basis.

Global markets

US Stocks

US stocks continue to remain strong on optimism around the economy with no sell signals being generated. For our interpretation that stocks are in the final phase of the bull market since the GFC, the current upside acceleration / momentum needs to slow down pretty soon.

The current strong rally since Donald Trump’s election adds to our confidence with buying the first decent ~5% pullback.

US S&P500 Monthly Chart

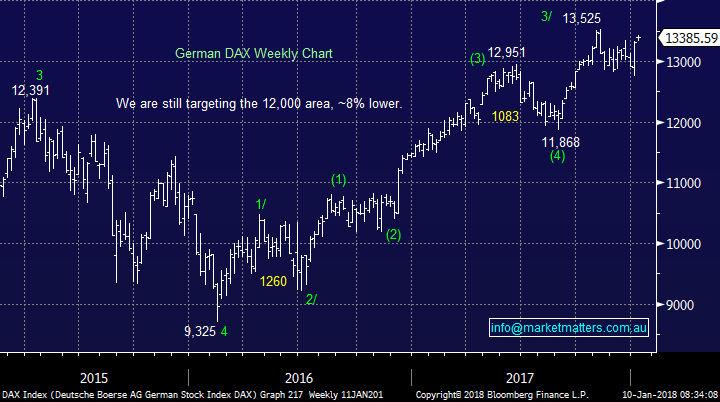

European Stocks

European stocks look set to make fresh recent highs, the big question is will they fail or kick on. At this stage we are sitting on the fail side, but only just!

German DAX Weekly Chart

Overnight Market Matters Wrap

· The US equity markets closed marginally higher overnight, with the broader S&P 500 on its sixth consecutive session in positive territory.

· Crude Oil is also gaining in its game of snakes and ladder, with the futures settling at 6-month highs.

· BHP is expected to benefit from crude oil’s performance, despite iron ore weaker, with BHP in the US ending its session an equivalent of 0.49% higher from Australia’s previous close to $31.21.

· The March SPI Futures is indicating the ASX 200 to open 26 points higher towards the 6160 area this morning.

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 10/01/2018. 8.00AM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here