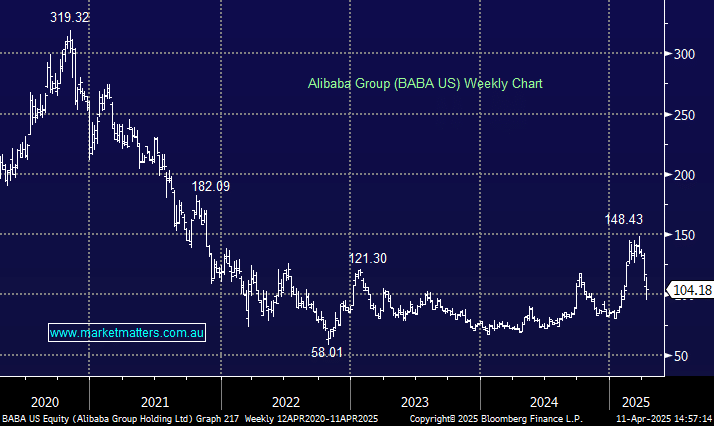

Alibaba (BABA US)

Hi James and team. My first question ever. I would like your take on one of the many threats which are emerging in this escalating trade war between US and China in particular the removal of Chinese listed stocks on the US stock exchange. As investors in the likes of Alibaba and JD.com etc is this something we should particularly worried about and should be taking this threat very seriously? Is it something that the US could implement without much effort and time and if so what would happen to our shares and more importantly the effects it would have on the share price in hong kong