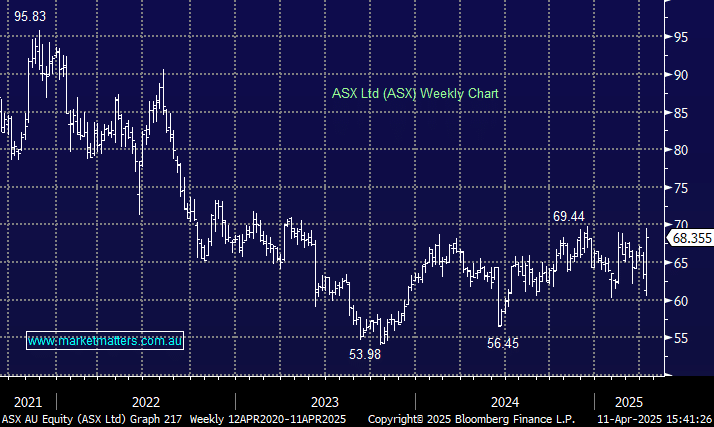

Takeovers and a shrinking ASX.

Hi Lately it seems like there is a new takeover offer for a listed ASX company almost every week. Whenever one of these takeovers succeeds it inevitably means that the target gets delisted and the pool of companies to invest in on the ASX gets smaller. At the moment there doesn't seem to be a stream of new listings to replace the ones that get taken out - just the occasional new one such as Digico or Gusman y Gomez. Does this mean the ASX could become less attractive as an investment option (especially for the big players)? Does the ASX need to try to attract new listings? Cheers, Carl