As many may know by now, ASX-listed bank hybrids are being phased out from 2027; however, in reality, the bank notes with call dates prior are also being redeemed, and it’s safe to say banks will not re-issue new securities again in the Hybrid market, CBA and ANZ being two recent examples. The insurers (& Macquarie Group), however, will still be able to access this pool of capital, and like the banks, insurers are regulated entities required to hold a specified level of capital. We like bank hybrids and insurers for this reason, and with bank hybrids set to be wound up, this brings the hybrids of insurers further onto our radar.

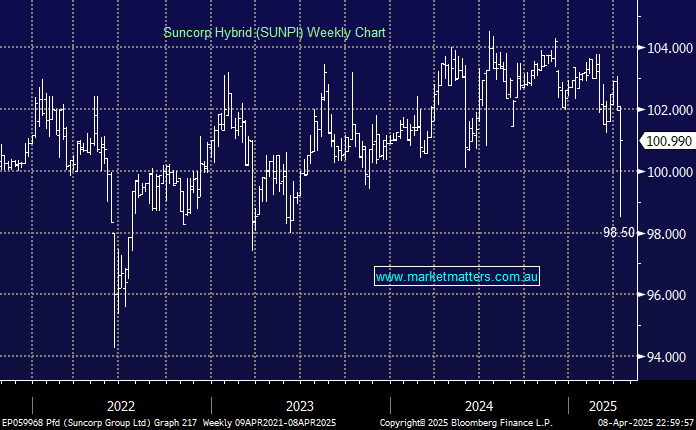

The SUNPI was issued on a margin of 2.9% in addition to the 90-day bank bill in 2021, with a first call date in June 2028. They currently pay a grossed running yield of 7%, though this will fall as interest rates come down, with every chance this security could be paying 6% by Christmas. When volatility spikes, hybrids and other defensive securities are often used as funding vehicles to either 1. Cover margin calls or 2. As a funding source for investors looking to buy the dip in equities. They are, therefore, susceptible to short-term weakness, which was the case with SUNPI.

We’re looking to add another Hybrid into the income portfolio, and the SUNPI screens well, though it was more attractive under $100 yesterday. It has ~31c of accrued income in the price, with a distribution of 53c coming up on the 30th of May. We see fair value anywhere below $102 (but obviously the lower the better). Buying under this level looks relatively attractive, particularly given SUN will likely roll this into a new offer in 2028, where existing holders (usually) get the opportunity to fully roll their exposure into the new security.