NSR has three primary rivals, including Abacus Storage King (ASK), which this week received a $1.9bn takeover bid from South African tycoon Nathan Kirsh (Ki Corporation) and US Public Storage (PSA US). The bid represented a 26.7% premium over the company’s closing price of $1.16. The proposal is non-binding and subject to conditions, including due diligence and the usual regulatory approvals. The bid reflects the consolidation trend in the self-storage sector, with US Goliath Public Storage aiming to expand its presence in the Australasian market. Back in 2020, three suitors chased NSR, including the same PSA, but COVID ended the bidding war:

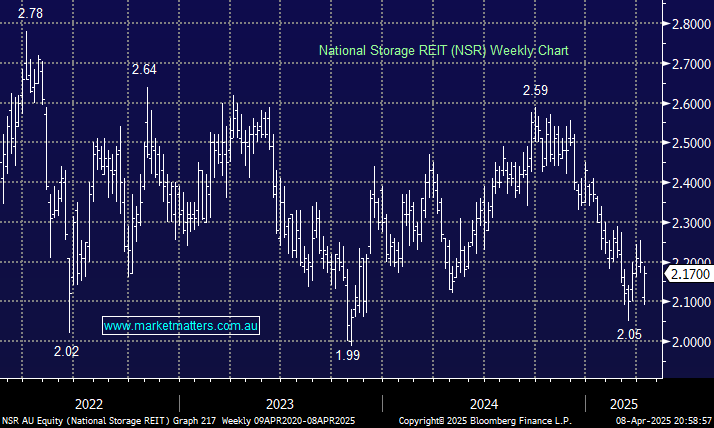

- In early 2020, Public Storage bid $2.40 per share for NSR, valuing the company at a similar $1.9 billion; COVID killed that deal, and NSR remains ~10% below their offer.

- The consortium bid for ABK values the storage operator at 21.5x Est FY25, putting the stock on a yield of around 4.5%.

- Comparatively NSR closed yesterday on an Est FY25 valuation of ~18.7x and a yield of around 5.1%.

The current bid for ASK makes NSR look cheap, and it screens even better compared to how it has traded over the last five years. Based on yesterday’s close, NSR was trading ~18% below its average, building a comforting margin of safety for this defensive REIT – the recent market volatility has illustrated how portfolios benefit from some defensive-facing positions, especially when they pay a reasonable yield.

Traders have now ruled out another takeover bid from PSA for NSR, but the stock still looks excellent value under $2.20, especially in the current volatile and uncertain environment. Also, Hong Kong-based Gaw Capital Partners and private equity firm Warburg Pincus may rekindle their interest in the storage business, but this is not why MM holds the stock in two of our portfolios. As Australia strives to resolve its acute housing crisis, higher-density living is inevitable, which will drive the demand for people to store “stuff” in the years ahead, just what NSR offers.

- We remain bullish on NSR over the coming years. MM holds NSR in both of our Active Income and Active Growth Portfolios.