Hi Carl,

We like yourself largely held on for the ride although we did rue not adopting a more defensive stance having moved from a bullish to neutral stance on the day the ASX200 broke above 8600 – hindsight is a great investor!

In our opinion the selling which became aggressive into Monday came down to a few things:

- Initially we saw an aggressive unwind by the momentum traders of the top performing stocks through 2024; this bottomed first, pointing to a low earlier this week.

- This was coupled with a significant margin call across global equities as investors/traders found themselves too long and bullish at the start of 2025.

- We’ve read in a few places that “Liberation Day” will be renamed “Liquidation Day” – following the huge volume forced selling which washed through stock markets in the last week.

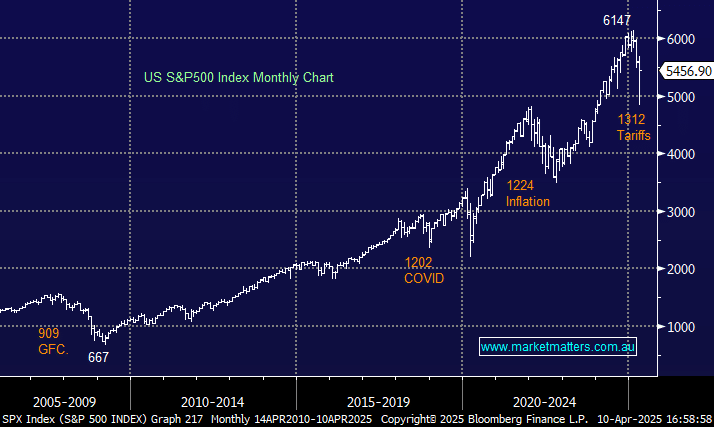

After being too conservative in February when the ASX200 topped out above 8600 we are going out on limb here, we believe the US S&P500 has bottomed and while its likely to consolidate around the 5500 area for a while we can see new highs into Christmas assuming a recession becomes a distant memory and the markets starts to refocus on tax cuts and deregulation.