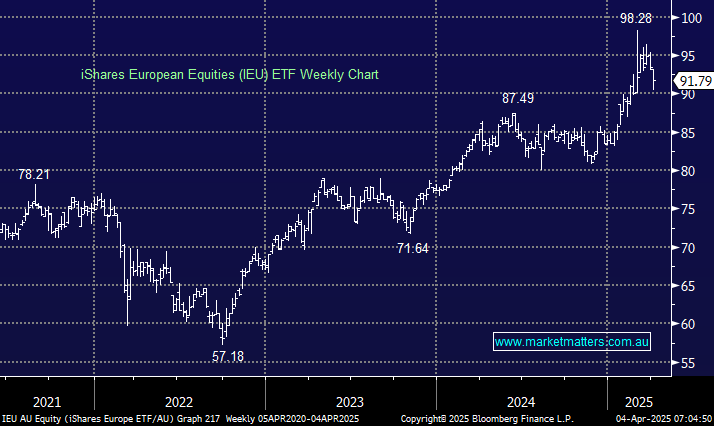

We continue to like European stocks through 2025/6, but the region will need to navigate Trump’s tariffs before it can return to business as usual. We have adopted a bullish stance towards the EURO STOXX 50 through 2025, but we have wound this back this morning as the fallout from Liberation Day takes hold. However, the first signs of diminishing trade uncertainty, and we can see ourselves donning our bullish hats again.

- We like the risk/reward towards the EURO STOXX 50 around 4500, still over 10% lower.

The tariff-inspired volatility is set to weigh on European equities in the short term; we are keen buyers if the IEU ETF falls back into the $80-85 area.

- We like the IEU ETF back around the $85 area, or 8% lower.