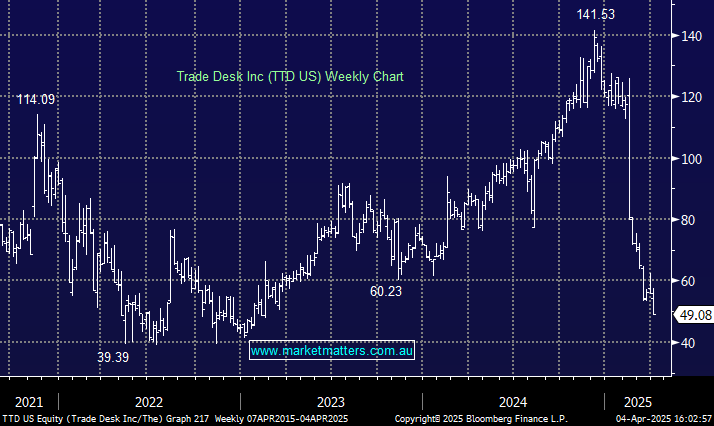

Trade Desk Inc (TTD US)

Hi MM, From memory, you thought TTD was a buy or even strong buy at about USD$80; and had it as as a recent top buy around USD$60. It has been hit particularly hard today. Is this due to concerns around an economic slowdown due to tariffs and consequent decrease in advertising spend, etc? At around USD49, does MM view it as extremely oversold? Or do the Liberation Day tariffs raise concerns that you did not have a week or so ago? Thanks Darren