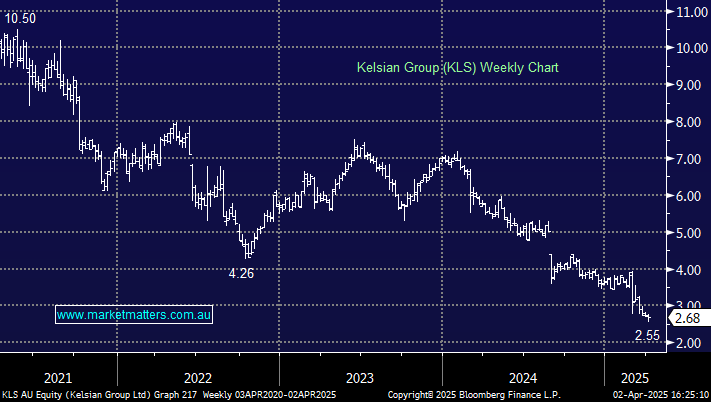

KLS +4.28%: Announced it is exploring the divestment of its Australian Tourism Portfolio. The Portfolio includes its K’gari Fraser Island resorts and SeaLink Sydney Harbour among other assets.

The Portfolio generated $160 million in revenue last FY, so will likely attract a decent price here though there’s not much in the way of listed comparisons from a valuation perspective on this one. Management has said proceeds will be used to de-lever the balance sheet, paying off some or all of its ~$933m debt as at 31 December – we see this as a smart move.

In narrowing the scope of its operations, Kelsian is pivoting to more of a commuter and contracted transport business focusing on government-backed contracts, which should help to deliver more predictable earnings.

Concerns around global economic growth continue to dominate sentiment, so the switch to an infrastructure-like business has been unsurprisingly well received by the market and should attract flows from investors looking to diversify their exposure to defensive equities.