Subscribers questions (QBE, BHP, WES, FMG, HVN, WPL, CSL)

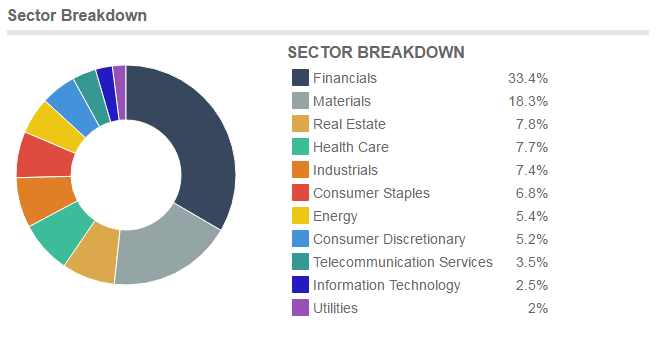

The ASX200 struggled last week falling -0.9% while global equities rallied strongly – it’s all about the relative sector weightings within the index and importantly the market interpretation of these sectors. The major difference between us and the Trump fuelled US rally is the banks,

1. In the US rising interest rates is propelling their banks higher i.e. +12% over the last 3-months.

2. Conversely locally are banks are being looked at by many as more of a quasi-bond hence rising rates is bad news i.e. over the last 3-months our banks are down -0.8%.

ASX 200 sector breakdown

ASX200 Daily Chart

The below chart while a little messy shows the downturn in the banks and large drop in the real estate sector – again all about rising interest rates. While BHP is rallying nicely it cannot offset the combined weight of the struggling sectors.

Comparison of sectors in the ASX200 Daily Weekly Chart

Question 1

"Dear James and team

I wonder why most analysts still seem to recommend QBE as a buy? It is down around 2% again today for no apparent reason. Regretably, I bought the stock on a recommendation at $13.69 and an currently showing a paper loss of $4700. I am thinking I should sell and try to find better value elsewhere.

Regards

Roger Lloyd"

Morning Roger, I answered you earlier on QBE but I thought it was something that should be shared with subscribers considering MM’s holding in the stock which is currently basically unchanged after giving back a large paper profit.

QBE is a difficult one. All the external things that help to drive earnings for it are improving however the business has so many moving parts that it seems one or two are always providing a drag, basically the market has been let down too often and no longer gives the company / share price any benefit of the doubt.

I had a good discussion with the ex-CFO not long ago who described the business well. It’s an uncontrollable beast with such huge amounts of leverage which has hurt it in times gone by. His view, and it was the one I shared when we bought it was that now, the first time in a long time external factors were aligning at a time when they had been aggressive is re-reserving many parts of the insurance business - so the chances of reserve releases were high as well.

At present I’m questioning our position however given our views on the macro (high rates etc) and our current cash holding it that Portfolio I’m leaning towards holding for now - but that obviously may change.

QBE Insurance (QBE) Monthly Chart

Question 2

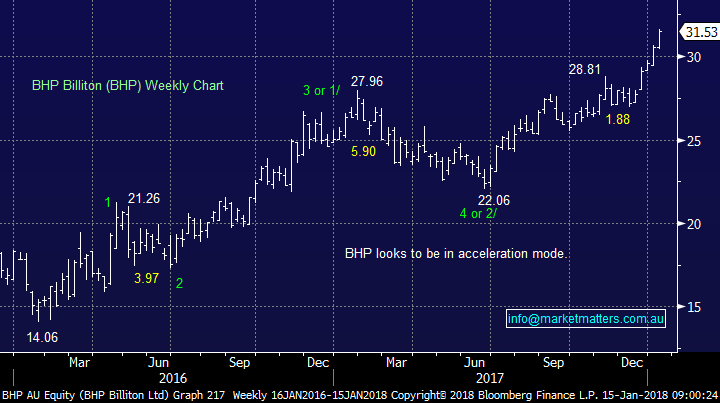

“I bought BHP at $28.50 3 weeks ago have you got a view on this stock buy sell hold?” - thanks Ross.

Hi Ross, great entry, we have been too fussy re-entering the “big Australian” after taking profit in 2017. MM is simply bullish both BHP and the sector, we are expecting to buy leaving room to average any $1.50-$2 pullback, so in a nutshell we believe it remains a buy.

BHP Billiton (BHP) Weekly Chart

Question 3

“Good morning, I currently own Wesfarmers (WES) shares in my portfolio and would like to get your opinion on whether the price will rise much more than the current level of around $44.60. Is it time to sell?” - Regards Steve

Hi Steve, in a general sense, the comments on WES in the “Weekend Chart Pack” out on Sunday probably sum it up best. Overall, we are neutral WES at present seeing better opportunities elsewhere however, WES is clearly an attractive ‘income stock’ with very little variance / high predictability in earnings and a dividend that will grow gradually over time. We would be more interested from an income standpoint below $40.

Wesfarmers (WES) Weekly Chart

Question 4

“Happy New year to all at Market Matters. We have a healthy portfolio of Australian Shares in our SMSF but now would like to diversify into International ETFs. I would appreciate your advice and guidance with respect to: 1) How and where to buy them. 2) Some of ishares ETFs like the Currency hedged MSCI Eurozone, Japan and Germany are quoted in US $ 3) Can these be purchased with AUS $? 4) Is it better to invest in Currency Hedged ETFs or in Unhedged? Looking forward to your reply.” - Best Regards. Shernavaz.

Good Morning Shernavas, A very good question and a topic that we’ll cover in more detail as the year goes by. There are now a huge number of Exchange Traded Funds listed in Australia plus we’re also seeing a new wave of listed Managed Funds (M Funds for short) which provide ASX listed exposure to active managers or more structured themes. For those that may not be aware, an ETF typically tracks an underlying index and is generally a low cost way of getting a diversified exposure. An M Fund is different in that it provides an active exposure to a theme, the same as a managed fund does and generally carries higher fees.

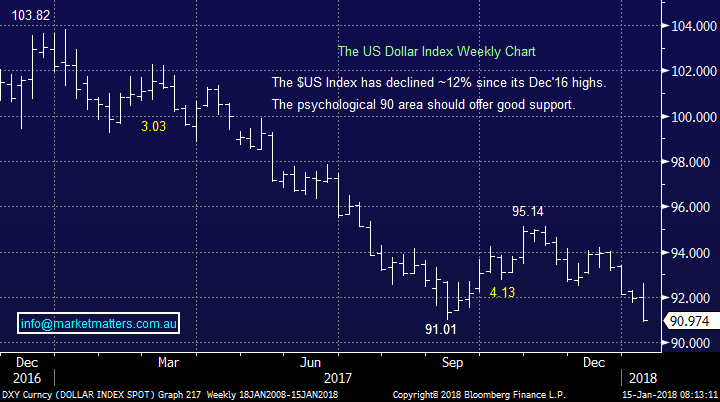

Below you’ll find a comprehensive list which provides a good starting point. The list includes about 180 products listed on the ASX and outlined whether or not a product is currency hedged or not. An unhedged product obviously throws up another challenge that can add to or detract from performance. Whether you should buy currency hedged or unhedged clearly depends on you view of the $A. Technically we can see it trading back under 70c if this proves correct unhedged $US works but currencies can be extremely hard to forecast accurately.

Interestingly, we intend to run an education piece in conjunction with Beta Shares on ETF’s early this year which should help answer some of your points. Keep an eye out.

CLICK HERE for full list of ETFs and M Funds listed on the ASX.

US Dollar Index Weekly Chart

Question 5

“On your recommendation I bought both HVN and FMG Is it possible to give me some idea as to what current target you have for these stocks Remember a figure of 4.60 odd mentioned for HVN not sure. I paid 3.78” -Jerry.

Morning Jerry, that’s great news, we always love to hear of subscribers making $$ from our alerts / reports.

1. Fortescue (FMG) $5.33 – We like FMG at present and can now see $5.50 in the shorter-term and a test of $6 medium-term – its rallied higher than we initially anticipated and in hindsight, we sold too early.

2 .Harvey Norman (HVN) $4.38 – While HVN can hold above $4.20 we are targeting the $4.60 area i.e. another 5% higher and will be sellers at that level in our Income Portfolio – watch for alerts

Fortescue Metals (FMG) Weekly Chart

Harvey Norman (HVN) Weekly Chart

Question 6

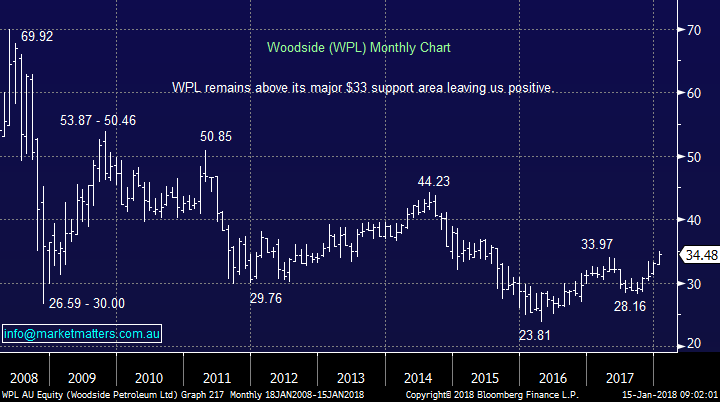

“Hi, I am keen to understand target exit price for WPL.” – Thankyou Jeff.

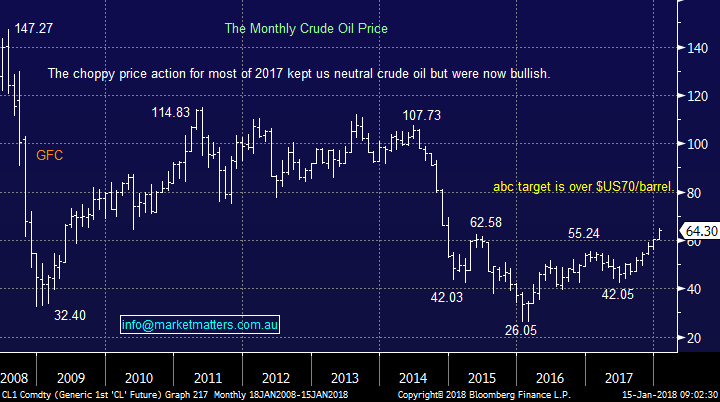

Hi Jeff, thanks for another very relevant question! Our exit price is based around our view for Crude Oil.

1. We are targeting crude oil to remain strong targeting ~$US70-71 a barrel, or about 10% higher.

2. We are targeting the $38 region for Woodside Petroleum (WPL) which is about 10% above Fridays $34.48 close.

We do see the potential of a larger rally in both but fundamentally this is hard to imagine with the threat to supply from the US shale producers likely as Oil climbs.

Woodside Petroleum (WPL) Monthly Chart

Crude Oil Monthly Chart

Question 7

“Re CSL I hold CSL but would like to increase my holding further. What would your thoughts be on an entry price as it seems to have cooled a little early New Year? There is no hurry for my adding to holding unless this is as low as you think it might go. Appreciate any insights and ultimately, I realise it’s my decision. PS Happy New Year $$$” – Deborah.

Hi Deborah, a great question as it feels like 2 large forces are at play against each other in CSL:

1. CSL is undoubtedly a quality global company who continue to go from strength to strength.

2. Conversely the healthcare sector usually underperforms when interest rates rise as do ‘high P/E stocks’ – our view which is currently unfolding.

While the rising interest rate picture remains in place we will be very fussy with buying both this sector and high P/E stocks.

With CSL trading on a P/E of 32x 2018 estimated earnings we can see the possibility of a pullback towards $120 in 2018.

CSL Ltd (CSL) Monthly Chart

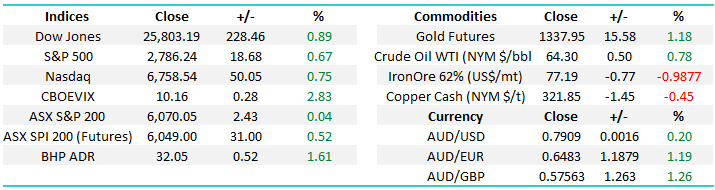

Overnight Market Matters Wrap

· The US equity maintained their positive stance, outperforming most global indices.

· Note the US is closed tonight for bank holiday

· On the commodities front, iron ore and copper over the weekend lost some ground, while gold futures and oil gained.

· BHP is expected to outperform the broader market today, after ending its US session up an equivalent of 1.62% from Australia’s previous close to $32.05.

· Local data today – investors will focus on the Melbourne monthly inflation data, which measures the change in price of goods and services purchased by consumers.

· The March SPI Futures is indicating the ASX 200 to open 11 points higher towards the 6147 area this morning.

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 15/01/2018. 8.00AM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here