Domain (DHG) announced on Thursday morning that it had received a “Best & Final” offer of $4.43 per share from US-listed giant CoStar, which had originally made a $4.20 bid in late February. This deal appears likely to go ahead, which raises the question of how hard REA will have to fight to maintain its dominant position, especially considering that REA has a market cap of $30 billion compared to CoStar’s $54 billion, implying that more firepower will be brought to bear in Australia by the US-based company.

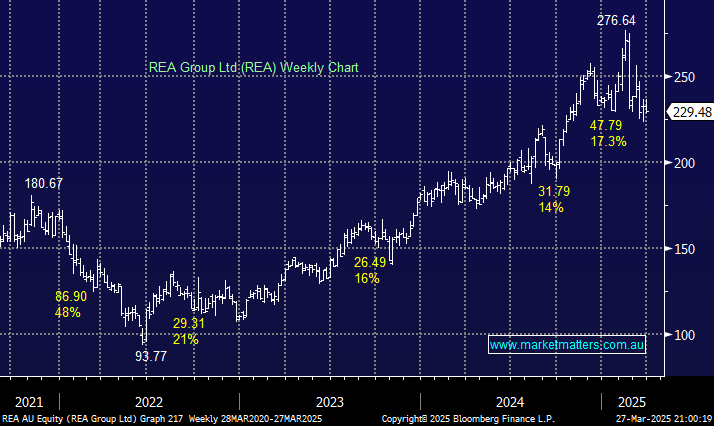

Since CoStar’s bid, REA has tumbled ~13%, but so have many other growth-style businesses. History suggests that CoStar is likely to invest heavily and ultimately put pressure on prices and margins to win market share. Regardless of whether it is successful or not, it cannot be good news for REA.

- We cannot rule out another 10% downside for REA, it’s too hard for us at the moment.