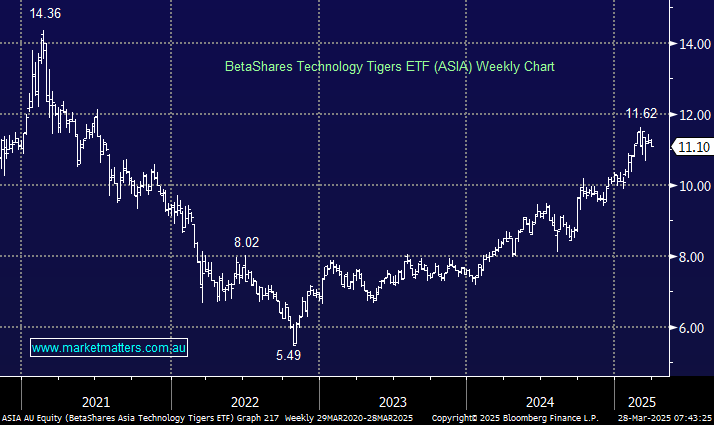

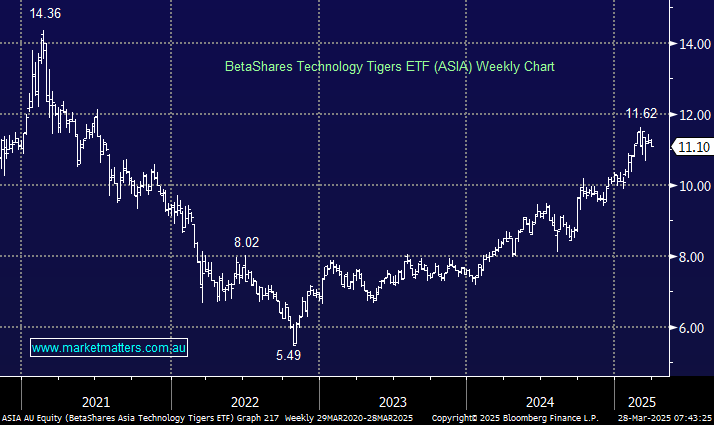

Asia looks poised to take, or at least share, the technology mantle with the US, something that tariffs may slow, but they won’t stop. Moving forward, MM believes that any portfolio seeking tech and growth exposure should have both Asian and US exposure. Keeping abreast of developments across Asian markets can be challenging for subscribers, making this ETF an excellent vehicle for the region and sector.

- We are optimistic about the outlook for Asian tech stocks, a view supported by recent impressive technological developments from the likes of DeepSeek and BYD over the last few months.

The ASX-traded ASIA ETF aims to track the performance of Asian technology companies, excluding Japan. Its current five most significant holdings, comprising Alibaba, Tencent, Samsung, Taiwan Semiconductor, and Xiaomi, collectively make up around 45% of the ETF. This is an excellent vehicle for gaining exposure to a basket of Asian tech companies, which can be challenging for some local investors to access. The fees are 0.67% per annum, which is not cheap for an ETF.

- We like the ASIA ETF initially targeting a test of $14 with an ideal entry on a dip back toward $10.50.