Canada raises interest rates & they very often lead Australia!

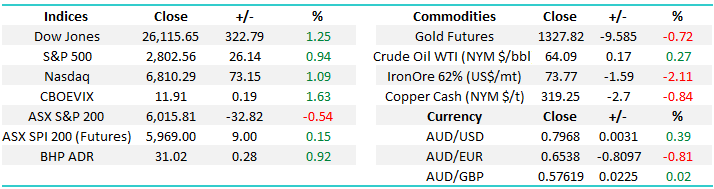

The ASX200 again fell yesterday to close down 33-points and -0.8% lower for 2018 to-date. The total disconnect with US stocks that we’ve witnessed since the US tax package was approved illustrates perfectly why local investors need to look at stock markets from an ever increasingly flexible perspective over the coming years – the Dow has rallied an impressive +5.6% calendar year to date.

The US is clearly basking in the extremely market friendly initiatives implemented by Donald Trump and his Republican party, very different to the fears when he was originally elected. As we mentioned in recent reports it’s not just Australia that’s failing to follow the US higher, Europe who the ASX200 tracked more closely over 2017 is also struggling to remain positive. If only more labour politicians held stocks Turnbull may be a chance of getting our own tax cuts through parliament!

Some fascinating macro-economic factors remain in play today but the important question is what will markets focus on in 6-months’ time:

- The US tax package plus other very strong economic reads is helping US stocks soar to record all-time highs.

- US interest rates are rallying for the same reasons hence fund managers appear to be switching from bonds to stocks, another huge support for US stocks.

- The Euro has rallied as investors believe the ECB will follow the US and commence raising rates in coming quarters.

- The $A traded up strongly yesterday, above 80c against the greenback, perhaps after Canada’s rate increase fund managers believe the RBA is about to kick into gear and commence increasing interest rates.

- The pronounced weakness in the $US still makes no obvious sense with the exception of China’s current lack of appetite for American debt / bonds.

MM’s thoughts moving forward:

- The RBA will join the party and raise interest rates at least 3 times over 2018/9, the current accommodative 1.5% is ludicrous with our economy ticking along pretty well – the main concern for the RBA is probably house prices which has a b g influence on consumer confidence in Australia.

- The $US will get some love in 2018, ideally from around the 88 region. The US should benefit from rising rates sooner rather than later. We’ll look to play this theme as it unfold.

- Stocks will continue to outperform bonds over the next few years as interest rates continue to rise.

Again, overnight we see the Dow up over 300-points / 1.25% but the ASX200 is poised to only open up around 10-points i.e. far from exciting. Our preferred scenario is we now see a test under 5950 by the ASX200 in coming days / weeks, we are watching very closely the spread between the ASX200 and the US S&P500, until we see an end to this divergence be prepared for underperformance locally as fund managers sell Australia and buy the US.

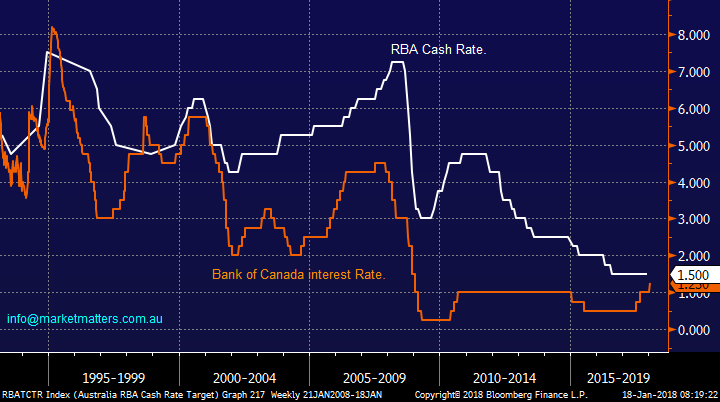

Last night the Bank of Canada increased interest rates, for the 3rd time in around a year, to 1.25% - a very optimistic read on their economy with NAFTA trade talks still creating uncertainty. Today we are going to again look at this North American country who may be miles away but whose economy and country have so many similarities to our own BUT importantly we believe they very often are ahead of us in the economic cycle.

ASX200 Daily Chart

Yesterday we allocated a relatively small 3% of the MM Growth Portfolio into BHP as it fell over 3% in early trade, while we remain keen to build a resources position for 2018 we are in no hurry to spend our large 23.5% cash position in the Growth Portfolio – it feels correct at present.

Yesterday we were unable to get filled, following our alert, in Z1P under 84c but will maintain the order in the market at least for today.

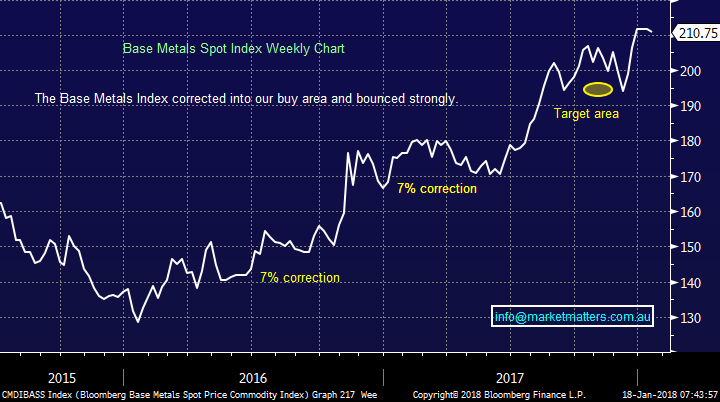

The upside momentum for base metals is slowly abating and after an impressive 2-year rally yet another 7% pullback feels a strong possibility which theoretically will create a buying opportunity in our resources space.

Bloomberg Base Metals Index Weekly Chart

Australia’s comparisons with Canada.

As touched on earlier Canada and Australia have very similar economies with significant dependency on commodities and massive land masses with a small number of large cities scattered on the coast lines.

Interest Rates

Canadian and Australian interest rates have tracked each other very closely over past decades which is no surprise considering the similarities of their respective economies. With Canada now raising interest rates 3 times in the last year, the only question appears to be when will the RBA start? Locking in interest rates now seems a good ploy for the next 5 years!

We’ve thought for some time now that the RBA will raise interest rates on Melbourne Cup Day this year but we believe the risks are for a move earlier. We believe the RBA will increase rates at least 3 times in 2018/9 with again the risk is if its 4, or even 5 times if inflation picks up.

Australian & Canada’s official interest rate Weekly Chart

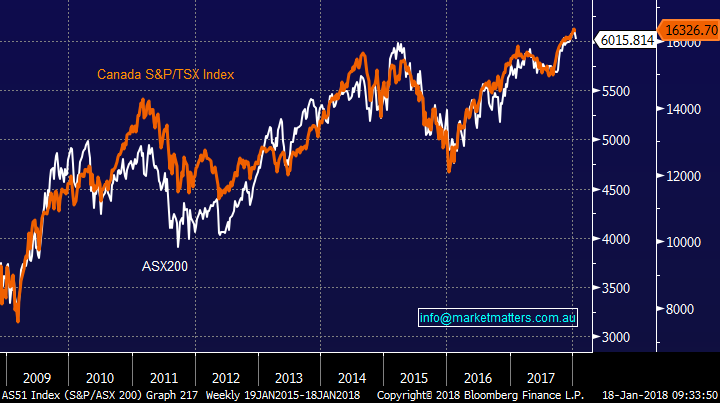

Stock markets

Looking now at the parallels between the Australian and Canadian stocks markets, it’s hard to argue with their correlation – doesn’t get much better! At this stage the Canadian market is holding up marginally better than we are, probably because they have commenced their interest rate tightening cycle – hence remember that when the RBA does start raising rates it’s not all bad news, just for specific sectors + the start of a rate hiking cycle is usually positive for the market, it’s when rates go up too much creating an economic sea anchor that stocks will start to struggle.

Unfortunately there’s no great leading indicator here as we had hoped, they move too closely – unfortunately this is typical research, there is not a golden nugget under every rock.

Canada v Australia – major indices

Housing Prices

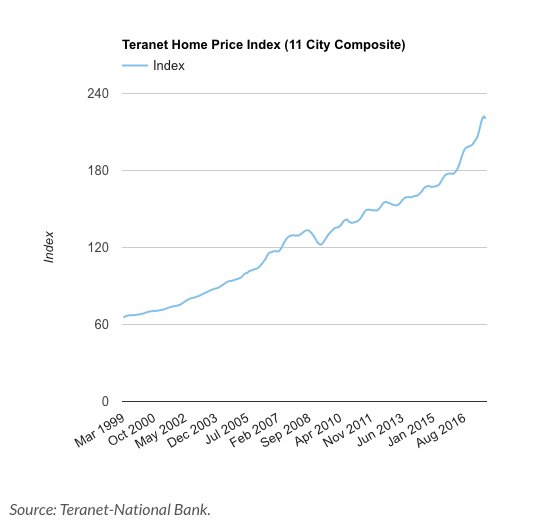

Canada has implemented a number of curbs to curtail its booming housing markets, very similar to Australia i.e. tighter mortgage standards and increased restrictions on foreign ownership. As discussed earlier they have also experienced 3 interest rate hikes with more potentially in the offing, but from a lower base.

However, Canadian house prices were still up 3% between October 2016 and 2017, not exciting but still positive. However when we look under the hood we see a -0.8% decline last September, the first fall in 21-months and they have continued slipping into 2018 from initial reports. When we look back over the last 20-years prices, are still accelerating up and a relatively small correction , similar to the GFC, would look almost healthy.

We expect a few years weakness / consolidation in both Australian and Canadian property – a best guess of ~15% on the average house.

Canadian House Prices Chart

Conclusion

Our snapshot look at Australia and Canada has led to 3 updated views for MM:

- Australia looks poised for 3-4 interest rate hikes in 2018/9.

- The ASX200 and Canadian stock market are very correlated with neither leading on a regular basis but we will continue to monitor Canada for any clues to forthcoming moves.

- Australian / Canadian house prices look ready for a few years consolidation with our best guess a ~15% pullback.

While MM is wearing its buyers hat, we will be patient into current weakness.

Global markets

US Stocks

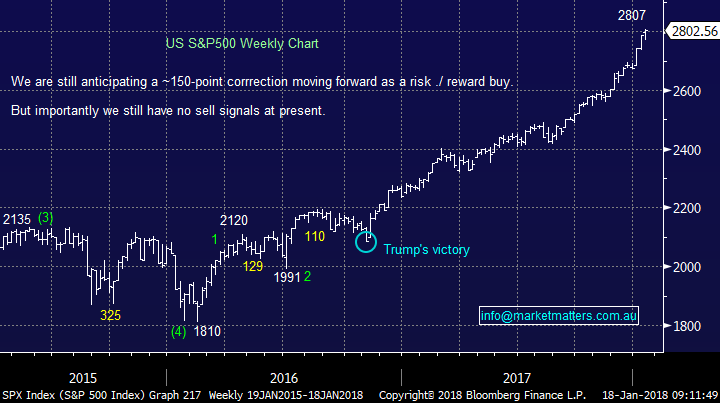

Tuesdays strong reversal implies that the 2800 area may prove a stumbling block for a while at least, we continue to think some consolidation is overdue.

US S&P500 Weekly Chart

European Stocks

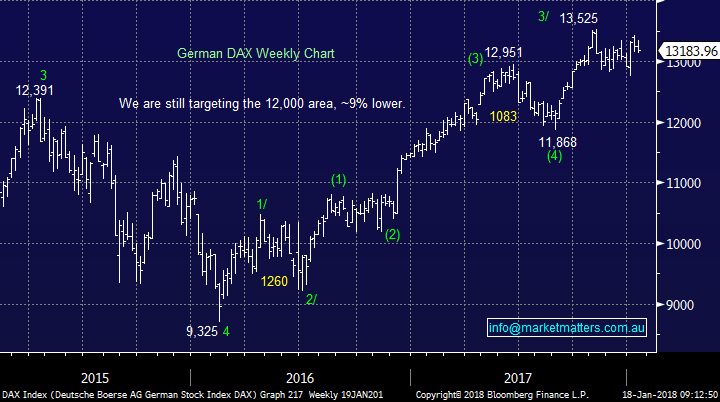

European stocks look set to make fresh recent highs the big question is will they fail or kick on. At this stage we are sitting on the fail side but only just!

German DAX Weekly Chart

Overnight Market Matters Wrap

· The US equity markets were buoyed overnight by good earnings for the December quarter, with its key indices once again heading into the close at near record levels set on Tuesday with the Dow above 26,000 and the S&P 500 above 2800.

· Bank of America led the financials after a strong quarterly, while the tech sector was led by a rally in key stocks including Apple, Microsoft and IBM

· Commodities were mixed, with oil rebounding from the previous day’s selloff, iron ore once again weaker, copper slightly lower and gold flat.

· The Bank of Canada raised its key interest rate target to 1.25% on the back of continuing strong growth and rising inflation. The $AUD continued its recent strength touching US80c for the first time since September last year.

· The March SPI Futures is indicating the ASX 200 to open slightly higher, towards the 6020 level this morning.

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 18/01/2018. 8.00AM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here