Hi Josh,

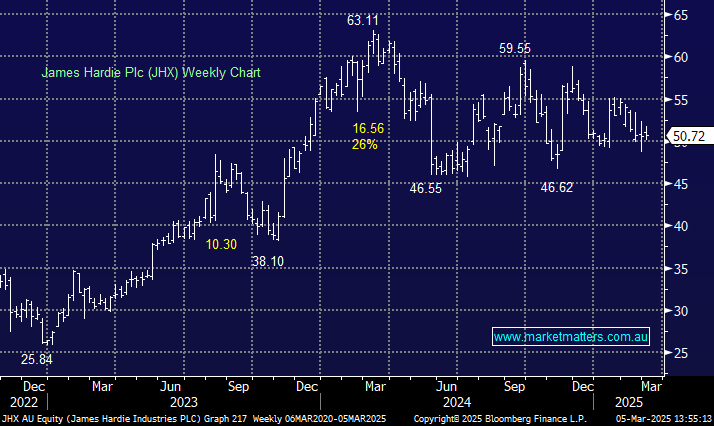

In terms of James Hardie (JHX) themselves we are comfortable, last month’s 3Q25 results came in slightly better than expected plus they reiterated FY guidance, although there was no commentary on the idle buyback. Reece (REH), which is also exposed to US construction markets on the other hand were soft, so it is patchy out there.

Clearly, the improvements to the US construction industry are taking longer to unfold than anticipated as tariffs weigh on industry and consumer confidence – over 70% of JHX revenue is derived in North America. Trump has said a “little disturbance” from tariffs is ok as volatility washes through financial markets but that’s a vague statement:

- New tariffs could increase build costs anywhere from $7,500 to $10,000 per average home.

- The greatest impact to homebuilders will be from lumber cost increases, which are expected to total about $4,900 per home on average, according to Leading Builders of America.

Roughly a third of the lumber used in U.S. homebuilding comes from Canada, and domestic lumber producers are expected to raise their prices to match the imported supply – lumber futures are up ~5% in the last week. We continue to believe the tariff issues towards Mexico and Canada will improve through 2025 BUT until they do JHX will struggle to meaningfully advance.