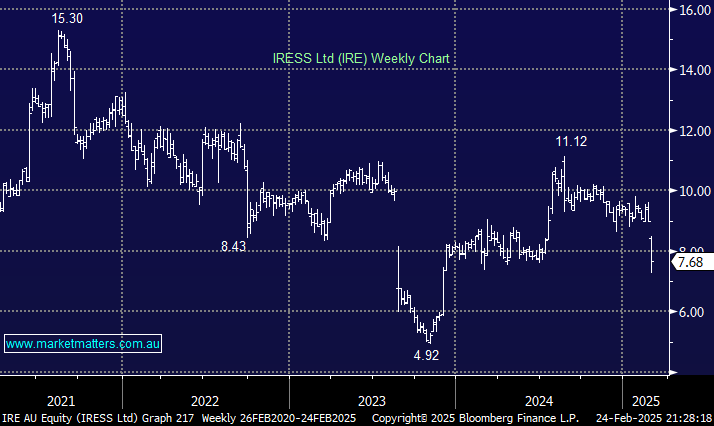

IRE was smacked 14.5% on Monday after reporting FY24 results that were weaker than expected and guidance for FY25 was underwhelming. Rising costs were/are the issue and this result will likely be a negative for Iress users (i.e. us) who will now be asked to pay for their inability to run the business efficiently, with price increases coming across the board.

- Revenue of $600.8n was down -4% YoY but largely inline with expectations.

- Underlying net profit of $30.1m missed expectations of $66m

- Final dividend of 10cps was a slight miss.

FY25 guidance for underlying earnings (Ebitda) of $127-135m and underlying net profit of $54-62m was around 14% below consensus and speaks to the share price reaction.

- We see no catalysts to interest us in IRE for the remainder of this FY.