Both Volatility and Opportunity are Awakening from their Slumber! (ANZ, CBA, BHP, RMD)

The ASX200 was thumped 52-points yesterday as the US futures began falling from around 2pm, that same selling has continued overnight with the Dow down ~400-points while I start typing.

Today’s report is fairly short as it’s all about action not larger macro themes, in other words it’s time to focus and act as opportunities arise. MM is sitting on over 20% in cash for our Growth Portfolio in anticipation of this pullback hence our buyer’s hat is firmly in place and eyes are fixed to the screens.

Subscribers should remember that our target for this pullback is around the 5925-5950 area for the ASX200, the market is set to open close to 5990 this morning i.e. clearly heading in the correct direction.

Obviously not all stocks will bottom with the index hence we are likely to slowly accumulate into current weakness.

*Watch for alerts.

ASX200 Daily Chart

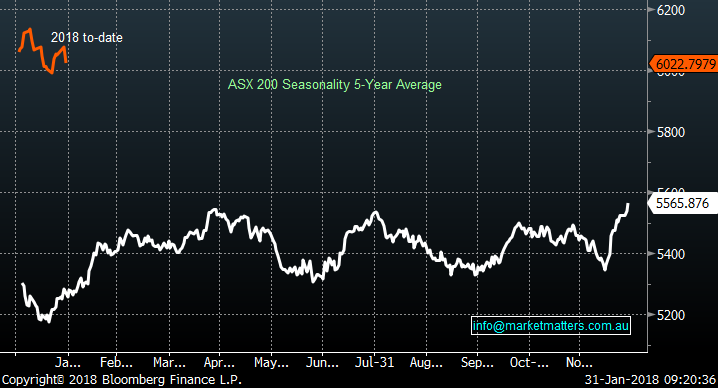

Also, subscribers should all remember that statistically since the GFC 80% of the time when the ASX200 has slipped in January, we have witnessed a low for Q1 around the first week of February.

This seasonal pattern is currently playing out perfectly.

ASX200 December Seasonality Chart

US interest Rates

The straw that appears to have broken the back of US stocks over the last 48-hours has been the big elephant in the room – interest rates. US Treasury 2-year yield reached 2.12% last night and are now paying a greater return than stocks and its risk free!

For the last 6-months people have been focusing on the flow of money from bonds into stocks but suddenly the rhetoric has turned on its head and we are hearing noises that a safe bond yield above that being paid by an expensive stock market makes more sense.

Comparison of US stocks and 2-year bond yields

Reviewing a few stocks that we have been watching over the past month to help us press the “buy buttons” – remember our ASX200 target is ~5930, or only 1.5% lower.

If our target area is achieved it will be a 3.6% pullback from our January high, we expect the local market to outperform the US if a decent global correction does unfold – it’s about time!

1 Australia & New Zealand Bank (ANZ) $28.48

Technically, ANZ has looked set to break under $28 to complete its pullback from $30.80, making it close to a 10% correction.

We sold half of our Westpac (WBC) position into the late December euphoria looking to buy back into the sector around now.

We currently have an order to buy an additional 2% CBA under $78, this may get filled / tweaked in the coming days.

ANZ Bank Daily Chart

Commonwealth Bank (CBA) Weekly Chart

2 BHP Billiton (BHP) $30.34

We have been targeting BHP around the $30 region to add to our position, the stock looks likely to open about 1% above our targeted area this morning.

We will continue to look to add to our BHP position, probably under $30.10.

BHP Billiton (BHP) Weekly Chart

3 Resmed (RMD) $12.30

We touched on RMD recently as a company which we like with both excellent $US earnings and growth.

We are interested buyers of RMD under $12, which is a 6-7% correction from the recent high.

Resmed (RMD) Weekly Chart

Global Indices

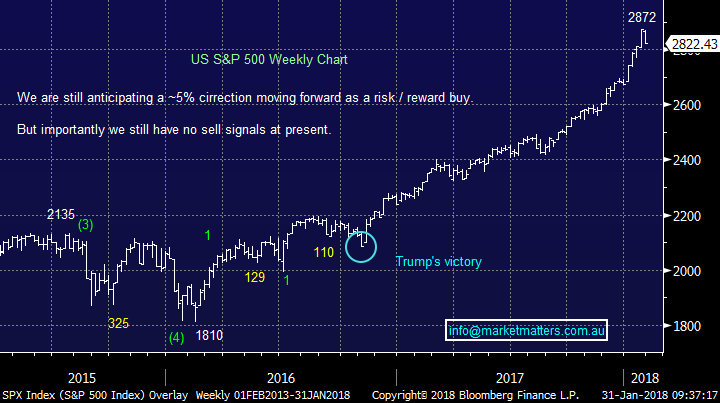

US Stocks

US equities closed significantly lower overnight as the psychological levels of 26,000 for the Dow and 2800 for the S&P feel likely to be tested / broken on the downside over the next few days.

At this point in time we have to believe that US stocks are in the process of correcting 5%, ending the longest run in history without such a pullback – US stocks just “feel” wrong at present.

NB If we are going to see a ~5% correction by the S&P500 we are not even half way there!

US S&P500 Weekly Chart

European Stocks

No major change with our preferred scenario for the German DAX a 9% correction back towards the 12,000 area for excellent risk/reward buying – this implies strongly that a global correction by stocks is just getting under way.

German DAX Weekly Chart

Conclusion (s)

We are buyers into current weakness over the coming few days.

*Watch for alerts.

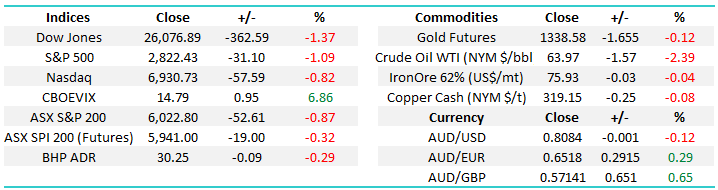

Overnight Market Matters Wrap

· Global markets felt the heat of rising bond yields and increasing inflation concerns overnight with the Dow Jones at one stage falling over 400 pts (-1.5%) - its biggest fall since early last year, before recovering slightly in late trading. All 3 key is indices are between 0.8% and 1.3% weaker heading into the close.

· After one of the strongest starts to the year for US equities in recent history, investors jitters have been driven by increasing inflation concerns, leading to US bonds hitting near 4 year highs of 2.73% and a significant increase in VIX index (the” fear” measure) to around 15. This coming at a time with global equities facing stretched valuations after the recent bull charge.

· Healthcare stocks in particular suffered overnight, after it was revealed a joint venture of Amazon, JP Morgan and Berkshire Hathaway planned to compete in the sector, in an attempt to bring costs down for the consumer. Apple also hit a 3 month low on concerns over iPhone X sales levels and potentially being the subject of a government Enquiry.

· The March SPI Futures is indicating the ASX 200 to open 23 points lower, testing the 6,000 resistance level this morning.

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 31/01/2018. 8.00AM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here