Your general thoughts please

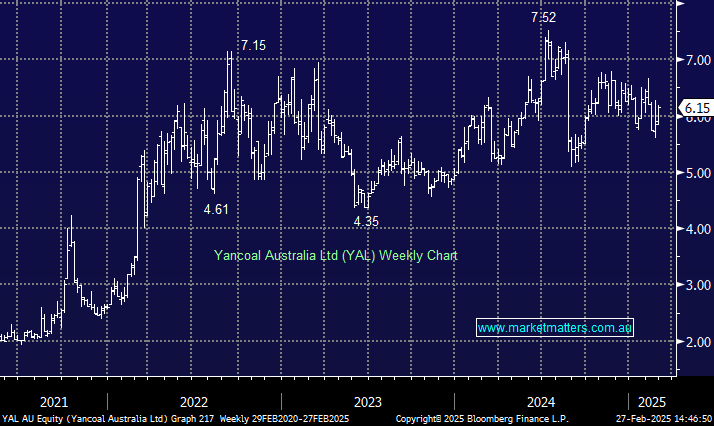

Hi MM, Just require general commentary (not financial advice ) 1) why has not the share price of YAL reacted, more positively to the recent result, declaring a return to payment of a massive +12% (74c) gross final dividend. 2) Is NXT a hold or a sell/ switch to GMG 3) comments on MYR softening share price post PMV deal Thanks Bill Do you think YAL is worth buying at these levels as part of an income portfolio? - Colin