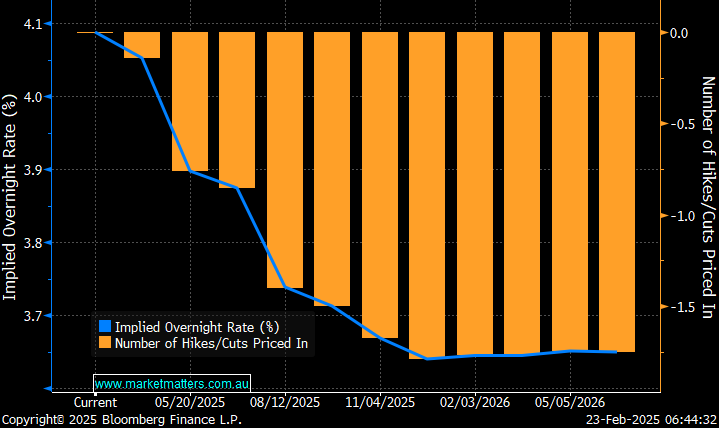

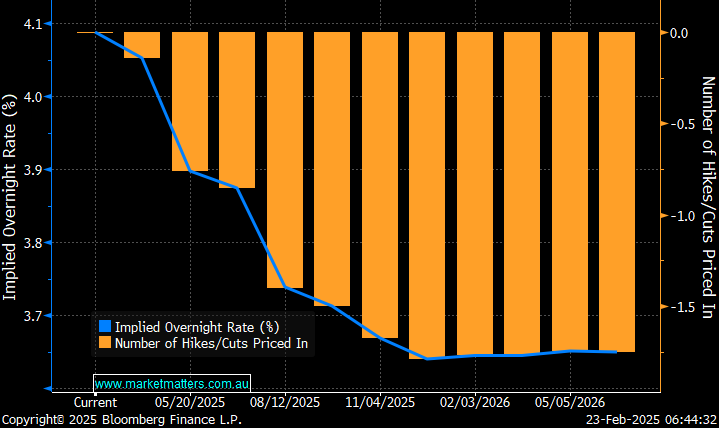

We received our much-anticipated 0.25% rate cut last week, which, based on auction results from the weekend, already appears to have improved sentiment across the housing market. However, the cautionary rhetoric that accompanied the easing saw credit markets start to reduce the chances of two more cuts in 2025, although the weight of money is still betting on a Cash Rate of 3.6% by Christmas – too dovish in our opinion. Interestingly, the markets expect rates to remain flat in 2026, wherever they finish this year, let’s hope it’s 3.6%!

- We are looking for one more rate cut by the RBA before Christmas.

Ironically, after all the speculation around the RBA rate cut and Michele Bullock’s accompanying message, the short-dated 3-year bonds were little changed last week, hovering around 4%. Bonds have called the path of rates pretty well, with the local 3s primarily rotating ~4% for over 18 months; the next chapter in the local economy will need to show its hand before this equilibrium changes.

- We expect the local 3-year yield to test 3% in the coming years, but it’s likely to be a slow journey.