Watching our “Buy Buttons” very closely (BHP, ANZ, CBA, JHG, ALL, RMD)

January is behind us and it was pretty average for the local ASX2000 which after an exuberant start finished down -0.5%, it could have been much worse if we had not recovered so impressively yesterday. At MM we believe that the ASX200 will outperform US stocks during periods of weakness in 2018 and this view is on track with a sample size of just one! At this stage I feel that while volatility is clearly raising its head after fermenting below the surface for a while the next (this) pullback remains a buying opportunity.

Not surprisingly the interest rate sensitive stocks like Real Estate (-3%), Utilities (-5.3%) and Transport (-2.9%) had the poorest January and they remain our “avoid” sectors until further notice.

MM is now sitting on 17.5% cash in the Growth Portfolio following our purchase of BHP yesterday and today we are simply going to keep our finger on the pulse with regard to looming buying opportunities.

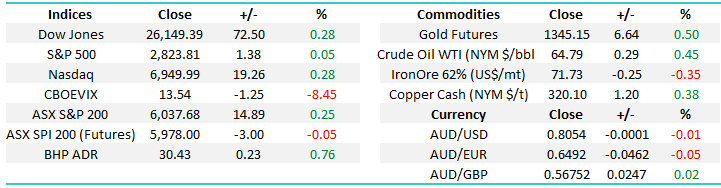

ASX200 Monthly Chart

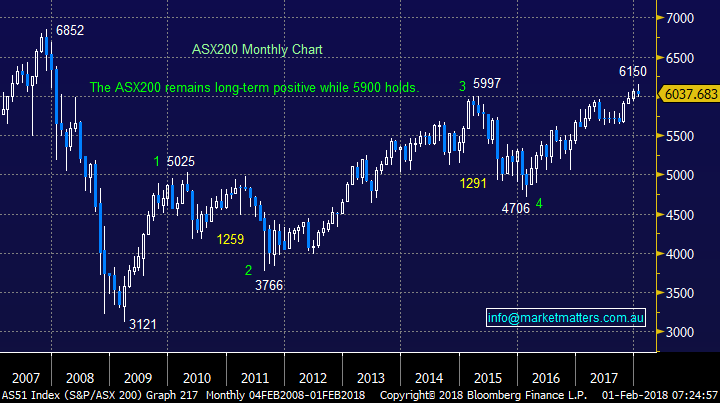

The US Volatility Index has been suggesting a correction was imminent having risen over recent weeks in line with US stocks, as opposed to its usual path of moving in the opposite direction. However we have been up to the current 14-15% area a few times in the last few years without any follow through and at this stage we have no reason to believe this won’t be the case early in 2018.

Also US stocks may feel volatile today but it’s only a “blip” on the radar with regard to the last few years. The Dow may have corrected 400-points from last week’s high but it’s still closed up 2000-points / 8% for the month.

US Fear Index (VIX) Weekly Chart

At this point in time we are still thinking that the ASX200 will give us a typical quarterly low in early February, hence our plan to increase our equity exposure in the coming sessions.

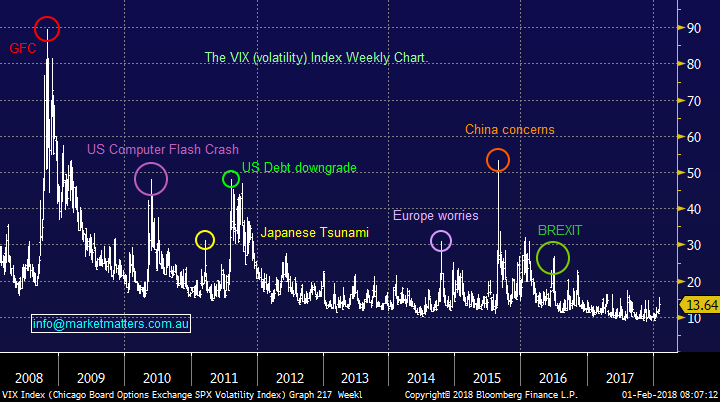

Banks

No change at this point in time:

- We have an order in the market to buy CBA under $78 i.e. just over 1% lower.

- ANZ still looks like an good barometer for the sector as it targets a short-term move under $27.90 i.e. 2.4% lower.

Commonwealth Bank (CBA) Daily Chart

ANZ Bank (ANZ) Weekly Chart

Resources

We remain underweight resources, looking to accumulate weakness, yesterday’s purchase leaves us holding 6% in BHP and 7.5% in Newcrest Mining (NCM). Some of our targets after recent volatility are as below:

- Alumina (AWC) sub $2.10 – current price of $2.41

- Oz Minerals (OZL) around $8.80 – current price of $9.35

- Rio Tinto (RIO) around $75 – current price of $76.85

- Independence Group (IGO) around $4.70 / Western Areas (WSA) under $3. Current prices of $5.03 & $3.30 respectively

- Sandfire Resources (SFR) under $7. Current price of $7.19

- Orocobre (ORE) under $6.50. Current price of $7.18

- Iluka (ILU) around $9. Current price of $10.12

BHP Billiton (BHP) Weekly Chart

Financials

The financials actually had a good January closing up +1.4% led by Perpetual which rallied over 8% - we hold PPT in our Income Portfolio. We have 2 targets in this sector:

- We may add to our JHG position around $47.

- We are interested in Macquarie Bank (MQG) around $96.

Janus Henderson (JHG) Weekly Chart

$US exposure

With the $US languishing close to 4-year lows some buying has emerged in the $US earners – it feels like some fund managers are in agreeance with our bullish $US opinion following an early 2018 low

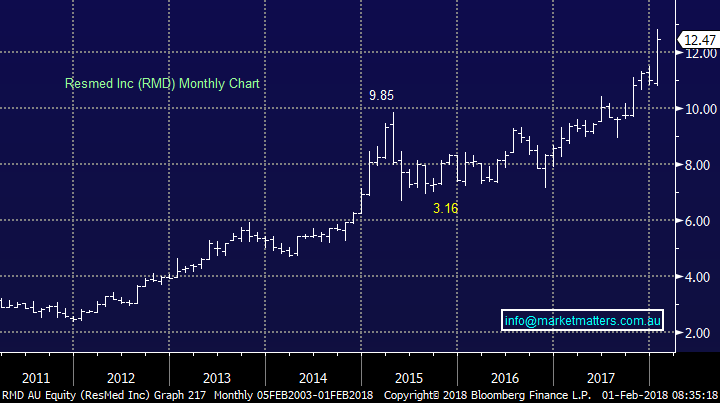

However the problem is finding value and good risk / reward in this popular sector. We have 2 favourites if the opportunity arises:

- ResMed (RMD) around the $12 region, however high P/E stocks like RMD may feel the pressure of higher interest rates

- Aristocrat (ALL) back towards late 2017 lows ~$20 which feels a lot lower at present but the stock can be extremely volatile.

ResMed (RMD) Monthly Chart

Aristocrat Leisure (ALL) Monthly Chart

Conclusion

No change, at this stage on the macro level, MM remains keen to accumulate stocks into weakness and sell gold (NCM) into strength, or potentially weakness.

We anticipate buying some of the names at levels outlined above.

Watch for alerts.

Global markets

US Stocks

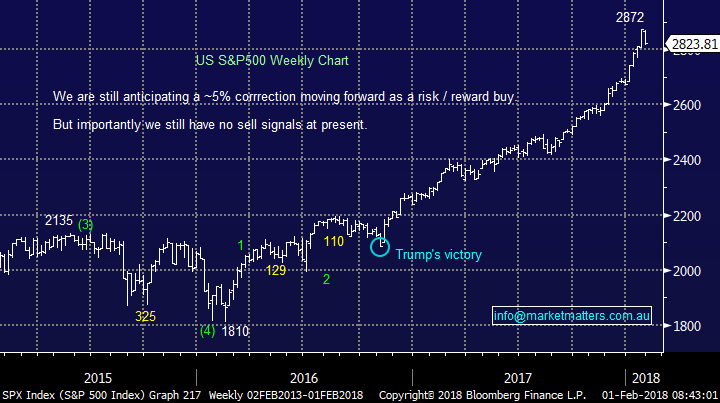

The S&P500 has corrected 2% so far, it feels like far more to me! Our ideal target for this decline is ~2780 i.e. only another 1.5% lower. In the short-term we expect a few days choppy price action.

US S&P500 Weekly Chart

European Stocks

European stocks have made a new high, and are now showing signs of failing.

German DAX Weekly Chart

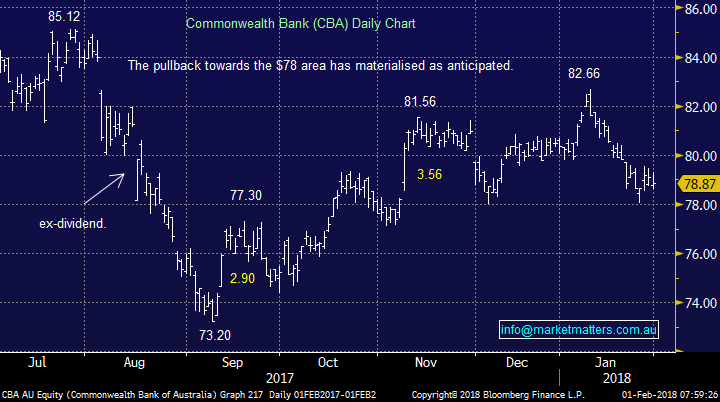

Overnight Market Matters Wrap

· Wall St struggled to hold onto early gains and is heading into the closing bell flat after the Federal Reserve kept interest rates unchanged.

· All three key US indices saw their best in early trading with the Dow leading the rebound, up nearly 1% on the opening, but have sold off in the afternoon, with all three key indices now flat or slightly in the red.

· The Federal Reserve, which met for the last time under chair Janet Yellen, indicated inflation was on track for around the target 2% level during 2018, thus fuelling expectations of further rate hikes this year. US ten year bonds were once again under pressure rising to near 4 year highs of 2.75% at one stage, but closing around 2.72%.

· Commodity markets were once again mixed with base metals slightly firmer, especially copper (+1%) and oil slightly weaker and iron ore flat. BHP and RIO are closing a little weaker in US trading, and the A$ is around US80.5c.

· The March SPI Futures is indicating the ASX 200 to open with little change this morning, around the 6035 level.

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 01/02/2018. 8.00AM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here