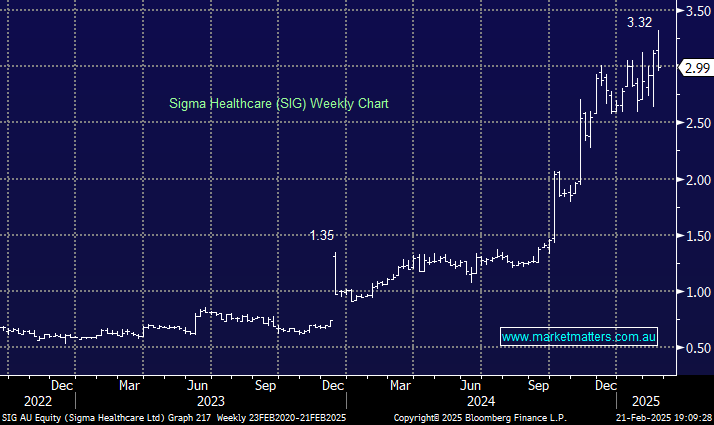

Sigma Healthcare (SIG)

i have been acquiring sigma shares since first announcement re chemist warehouse {CW} tie up initially at quite low prices but with buying intensified significantly after ACCC approval now entities have been combined since 12 feb i am a little puzzled by 1. sigma directors holding neglible skin in the game but outnumber CW directors with significant holdings of about 45 % of company which seems strange in view of lack lustre performance of sigma over many years under these directors 2. CEO of sigma ,relatively new from sth africa and unknown, has been appointed CEO ahead of CW directors who appear to have the score on the board to date 3. feel if name changed to CW this may attract smaller investors because of strength of name instead of sigma name not highly regarded for many years 4. major CW vendors have their shares held in escrow until aug however there were a number of smaller CW vendors whose shares are not subject to escrow one presumably being damien gance , a director, who was reported as selling 40m shares on day after combined asx lisiting i have not been able to get detgails of these smaller CW vendors where is it available please ? 5. as combinerd coy being reported as 32 nd largest coy on asx this would appear to mean that index funds institutions and the like would likely be buyers of stock some of which may have been satisfied by 40m shares sold as above surely this need to purchase stock should result in an increased price over the present $3 level they have been in last few days [ increase obviously appealing to me] as the experts in these areas i ask for your thoughts and /or comments on the above i eagerly look forward to your saturday reports certainly essential reading for small investors like myself many thanks morrie waters