CAT and yet another Gold Question

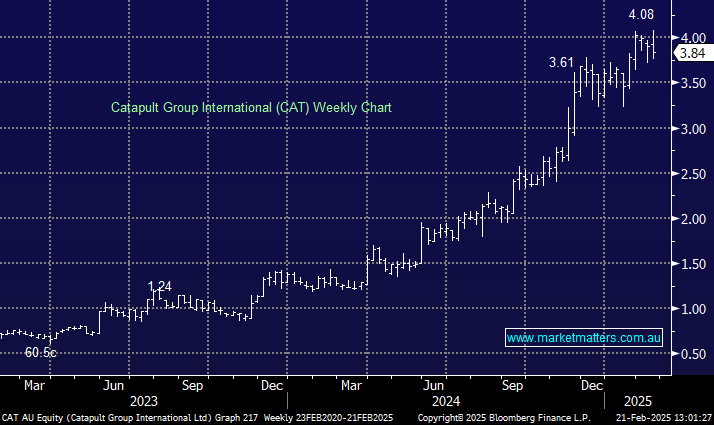

Hello James and the team, I have been with MM for some years now and still it is my best source of relevant and plain speaking analysis of stocks and the markets. My first question relates to CAT. I purchased it in the very low $2 range and have seen it have a stellar run over the last months. Many research and stock pundits still keep calling it a strong buy, but with such a run I am wondering what you view is for any further appreciation over the medium term. The paper profit is very appealing, but I dont want to give away what could be one of those "10-bagger" investors dream of. Secondly , with respect to the various gold mining companies. I read a lot of reports and results where the realized gold price from sales are disclosed, many of which are no where near the current spot rate. Obviously there are many forward contracts in play etc, My question is , over what period of time do you think a majority of Aust Miners will start to actually sell gold closer to the current spot price. With prices well over $4000 AUD surely the Aussie miners will soon start to reap some decent earnings. Thanks Michael