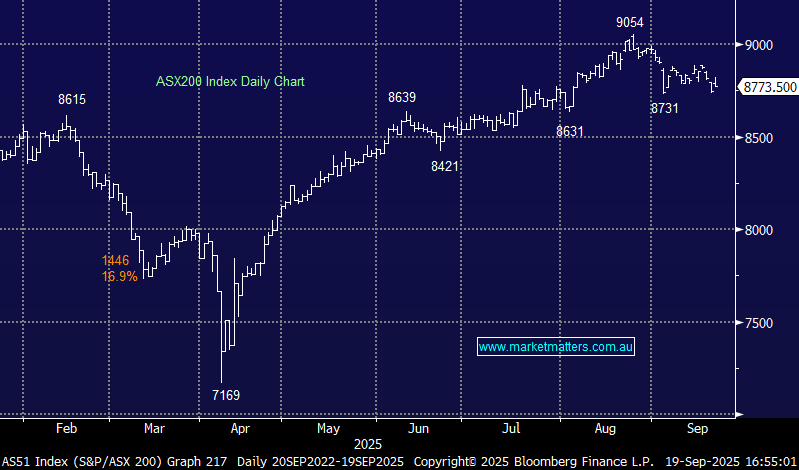

Last week, MGR delivered an good 1H25 result, which has seen the stock pop ~10% in rapid fashion. Notably, the company reaffirmed guidance, though the trends in the result had us thinking they are being conservative, and an upgrade feels likely prior to June if the current trends continue. While MGR is not the highest yielding investment on the bourse, with a ~4.9% unfranked yield, we view this as secure with a high chance of growing at a rate at least above inflation.

After a tough few years, MGR finally could be in the right place at the right time as rates are set to ease and the government, whoever it may be, fights to overturn a property crisis that has seen rents soar, weighing on consumers.

MGR enjoys a robust balance sheet with gearing at 26.3%, well within its target range. In addition, the business aims to execute over $500 million in non-core asset sales for further flexibility for what we believe will become an improving operating environment. With a strong project pipeline and a high-quality investment portfolio, the business has multiple earnings drivers for FY26, which should deliver both capital growth and strong yield.

- We are initially targeting a test of $2.50; it’s high for the last few years: MM is long MGR in its Active Growth Portfolio.