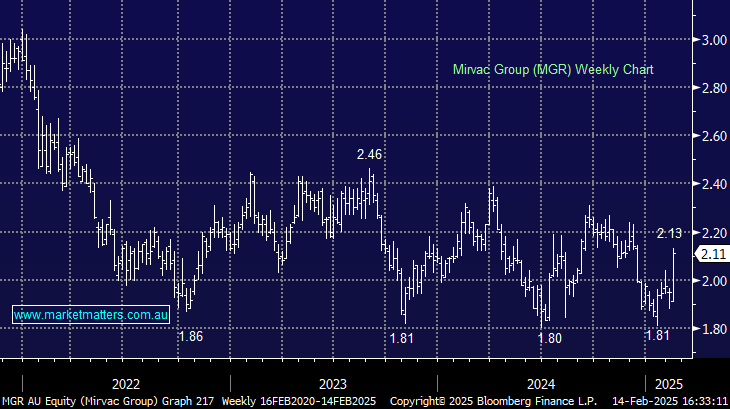

MGR +5.5%: Impressed with a solid 1st half result, remaining on track to meet its FY25 guidance.

- 1H total revenue $1.28bn, +1.8% yoy

- Operating EPS of 6.0c, 7% ahead of consensus at 5.6c

- Reaffirmed FY25 EPS guidance of 12-12.3cps, consensus at 12.0c

1ST half sales were impressive with residential sales surging 51% year on year, accelerating into the 2nd quarter with 601 lots sold verses 346 lots in the 1st quarter, driven by a successful launch of their Harbourside project in Sydney. Mirvac aims to sell a total of 2,000–2,500 residential lots so are well on track to complete this given improving run-rate through the end of the half. The balance sheet also remains robust with gearing at 26.3%, well within its target range and in addition to this, business aims to execute over $500 million in non-core asset sales for further flexibility in either reducing debt or expanding the project pipeline.

With a strong project pipeline and a high-quality investment portfolio, the business has multiple earnings drivers for FY26 – we continue to hold the stock in the Active Growth Portfolio.