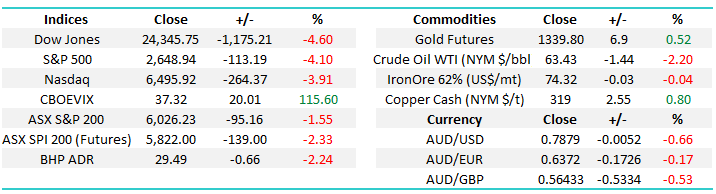

The masses are panicking, which equals opportunity!

The papers are having a field day as stock markets plunge across the globe but if you’ve been keeping your finger on the “MM Pulse” you will know it’s likely to be an opportunity. The world is enjoying synchronized global growth but interest rates are finally and logically rattling the cage of stocks:

- While I type the Dow is still only trading where it was back in early January – note it is moving about 100-points a minute!

- However US bond yields are back to the upper levels of 2014.

- We have recently seen Asian countries start to raise interest rates and the Philippines may join the party this week i.e. the region is joining the US party of increasing interest rates.

Importantly, we have been looking for a market low in early February with the expectation that all of January’s gains for US stocks would be given back. We’re now here, probably more quickly than we thought however we now must focus on putting plans into action. Today we are going to focus on 3 very important issues as the markets aggressively realign themselves for a whole fresh investment landscape:

- Looking at global indices for a clue to when this panic washout is complete.

- What sector(s) historically perform the best when interest rates / inflation rise.

- The stocks on our radar today plus importantly the levels we are looking to buy them.

MM is now sitting on 15.5% cash in the Growth Portfolio following our purchase of CBA yesterday, look for alerts this morning as we intend to increase our stock market exposure into this panic selling.

A. Global Indices

We have been targeting the 5900-5950 region to again go overweight local stocks, this looks extremely likely to be achieved / exceeded this morning.

ASX200 Daily Chart

US stocks have now corrected over 5% for the first time since Brexit, no great surprise after Fridays 665-point plunge. Takeout’s following this morning’s panic selling where the Dow was down 1500-points / 6% late in the day, before recovering marginally into the close.

- The US S&P500 has now corrected -8.1% and is now only around 2% above its long-term trend line support.

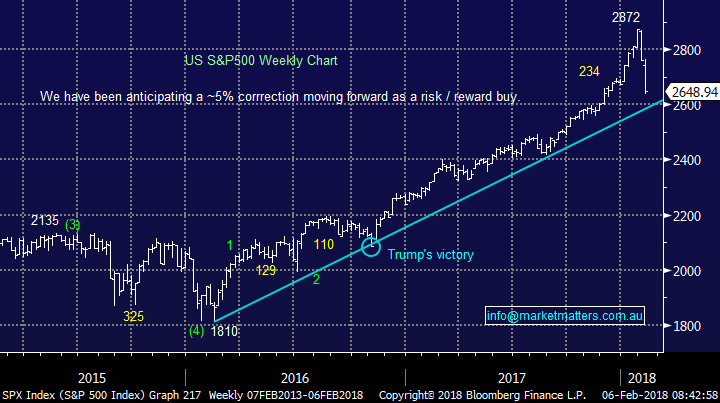

- The Dow has now corrected over 10% in a matter of days, this is actually not unusual. When a market rallies almost vertically the correction very often has the same force but usually plays out in a shorter period of time.

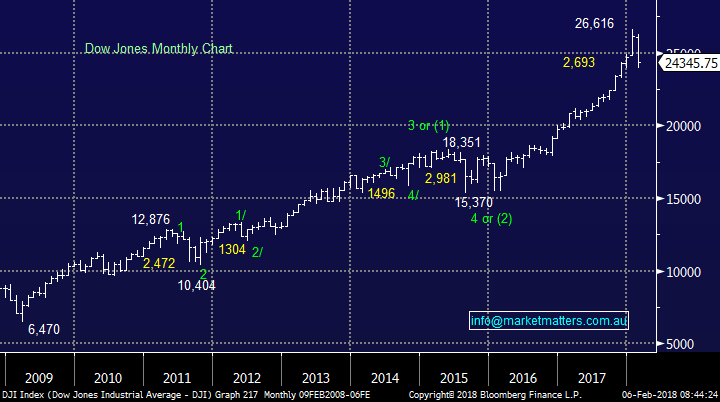

- We had wanted the Fear Index above 20 before a potential low was in place, this morning its over 30!

- We have been targeting a warning for complacent equity investors over recent months and its certainly manifested itself over the last few days.

Overall US stocks are now in the area where we can see a low forming and our opinion is they will be higher in say 10-days’ time.

US S&P500 Weekly Chart

US Dow Jones Monthly Chart

US Fear Index (VIX) Weekly Chart

Moving onto 3 other indices we watch carefully for clues to the overall direction for stocks:

- We have been targeting ~12,000 for the German DAX for many weeks and this looks likely to be achieved in the next 24-hours.

- Similarly the Hang Seng looks likely to reach our target area in the next 24-hours.

- The Emerging Markets Index has now corrected over 9% and is in our “buy zone”.

All 3 indices are saying it’s time to stand up and show some courage.

German DAX Weekly Chart

Hang Seng Weekly Chart

Emerging Markets ETF Weekly Chart

B. Sectors / Stocks for the new economic back drop.

With interest rates and inflation looking likely to increase further in 2018 /9 we ask the obvious question how should portfolio’s be structured:

Winners : Financials, Resources, Energy and Consumer Discretionary. Plus volatility!

Losers : Defensives such as Healthcare and the “yield Play” like Utilities, Real Estate and Telecoms (when they have been strong previously).

Gold is a harder one to pick but rising inflation in the past has been ok for gold even though interest rates increase but a strengthening $US would worry us more. Seasonally gold rallies in February before falling away for a few months.

C. The MM Shopping list

- Alumina (AWC) sub $2.15.

- Oz Minerals (OZL) around $8.80.

- Rio Tinto (RIO) under $75.

- Independence Group (IGO) around $4.70 / Western Areas (WSA) under $3.

- Orocobre (ORE) under $6.50.

- Iluka (ILU) around $9.

- Western Areas (WSA) around $2.85

- Janus Henderson (JHG) around $47.

- Resmed under $12.

*Watch for alerts this morning.

Conclusion

No change, at this stage on the macro level, MM remains keen to accumulate stocks into weakness and sell gold (NCM) into strength, this morning looks likely to be a great opportunity on this front!

We anticipate buying some of the names at levels outlined above.

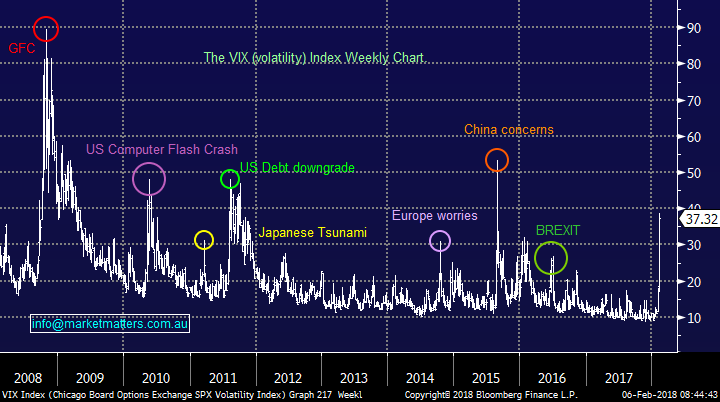

Global markets

US Stocks

The US NASDAQ has corrected 7.5% so far, it feels almost done for me! Our ideal target for this decline is the large trend line support, less than 2% below this mornings close.

US S&P500 Weekly Chart

European Stocks

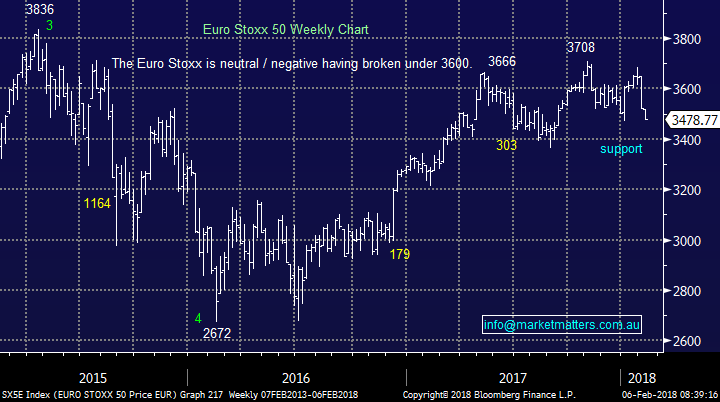

European stocks look set to make fresh recent lows tonight around 3400, our target for this decline and only another 2% lower.

Euro Stoxx 50 Weekly Chart

Overnight Market Matters Wrap

· Global markets continued to slide from its game of snakes and ladders, with the US equities market experienced its biggest one day decline late in the session, since the US debt downgrade back in August 2011.

· The Volatility (VIX) index rose to the 35 level, surpassing the BREXIT level whilst creeping close to the computer flash crash, US debt downgrade and China concerns.

· The March SPI Futures indicating the ASX 200 to open 145 points lower towards the 5880 area this morning.

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 6/2/2018. 8.00 AM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here