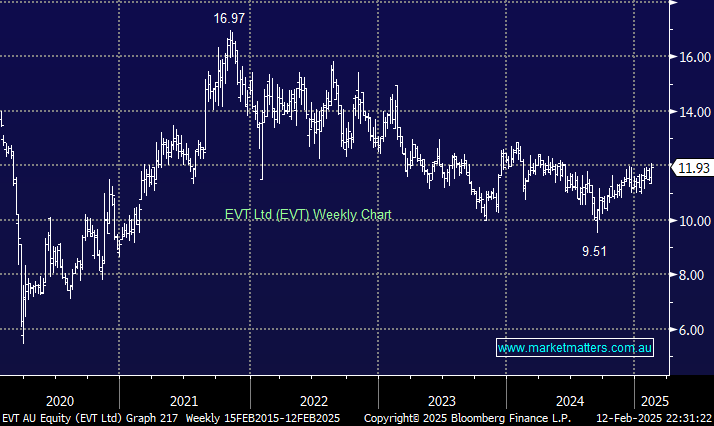

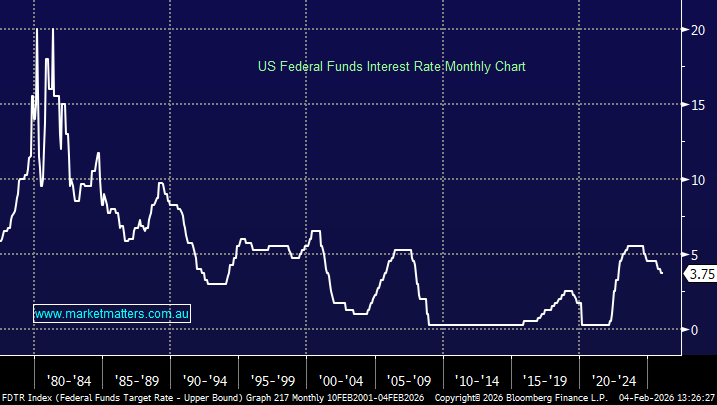

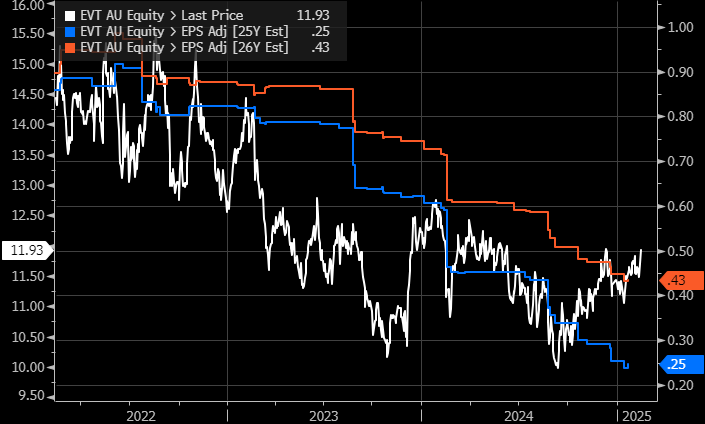

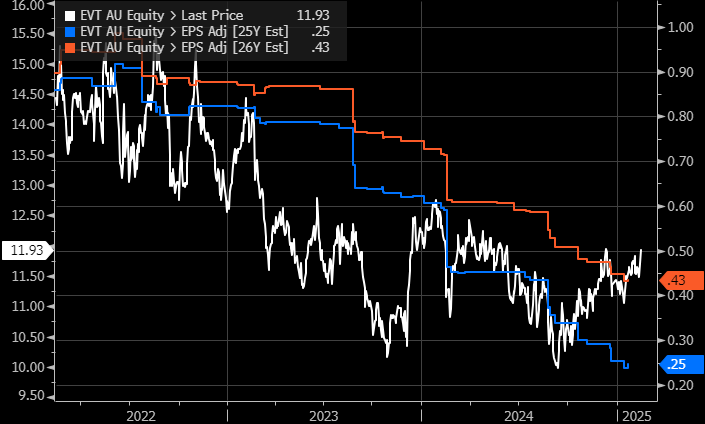

EVT Ltd gained +2% on Wednesday. The former Event Hospitality and Entertainment Ltd operates Event Cinemas, QT & Rydges Hotels, Sydney Ferries and Thredbo Resorts. The stock/company has struggled over the last three years, with the share price tracking earnings lower. Challenges in the entertainment and hospitality sectors have weighed on the business pushing the stock down ~30% from its 2021 high. However, with rate cuts around the corner, it is well-positioned to benefit from increased discretionary spending.

- The EVT share price has already started to price in a turnaround by earnings over the last six months.

The company is making a profit and paying a dividend, but it’s not as cheap as we believe the turnaround required would justify for MM to consider EVT.

- We can see EVT trading higher this year, but it’s not on our radar.