Hi Young,

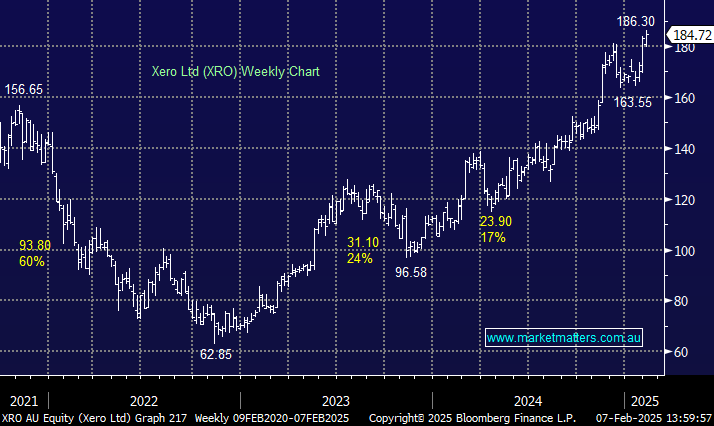

As you know we own Xero (XRO) in our Active Growth Portfolio and it remains arguably our favourite growth stock on the ASX200. Obviously on the surface a P/E of 128x for FY25 for XRO and 115x for WTC makes them both look expensive.

While they’re different businesses, looking out a few years into FY28, XRO’s earnings growth halves it’s expected PE and WTC does the same, implying the market has very similar growth rates (for earnings) factored in. WTC is more complex given its history of acquisitions, and that implies they will do more in the future, so that could change the earnings profile for them. We find XRO easier to understand and therefore predict earnings, so that’s the one we prefer.

- We like both XRO and WTC but prefer XRO at this stage.

Pro Medicus (PME) is another high-flying growth company, this time in the healthcare sector. The Australian medical imaging technology company provides advanced radiology software solutions for healthcare providers worldwide, and while it is trading on an Est P/E of 265x for FY25, its execution has been flawless. That said, while earnings growth is expected to be very strong, it’s just extraordinarily expensive, and where XRO and WTC have a path to becoming ‘sort of palatable’, there is just so much optimism built into PME, we can’t make it stack up, though clearly, this has been a fantastic growth stock we have not owned.

Buying pullbacks where the risk/reward looks more appealing is the only way we could play it, based on technical trends as opposed to more traditional fundamental measures.

- On a technical metric, PME would be a buy into dips below $250.

ANZ is forecast to yield 5.7% and should be fully franked very soon (given SUN acquisition increases the proportion of earnings in Australia). CBA is forecast to yield 2.89% fully franked, though it seems to us that analysts will prove too conservative.

We own ANZ because we think they’re future earnings and dividends will rise, pushing the shares higher.