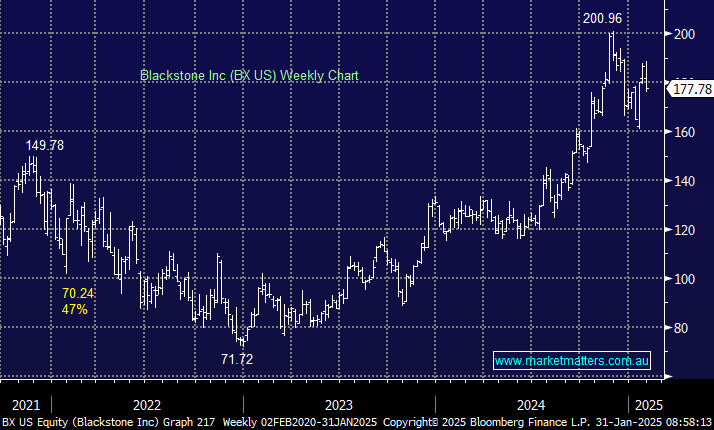

Q4 results out for the world’s largest alternative asset management company in the US overnight that were solid at the top line, though some weakness in Real-Estate saw the stock pullback;

- Fee-related earnings $1.84 billion, +76% y/y, ahead of $1.66 billion expected.

- Assets under management $1.13 trillion, +8.4% y/y, inline with estimate $1.13 trillion

- Real estate assets under management were $315.35 billion, -6.4% y/y, and below estimate $328 billion.

The real-estate division was softer than expected and that saw fee income for that area below expectations, which would have been the reason for a ~4% pullback in the stock. What was very interesting was the $168bn worth of dry powder they have, having deployed $41bn in the period.

- This result does not change our positive view on BX US