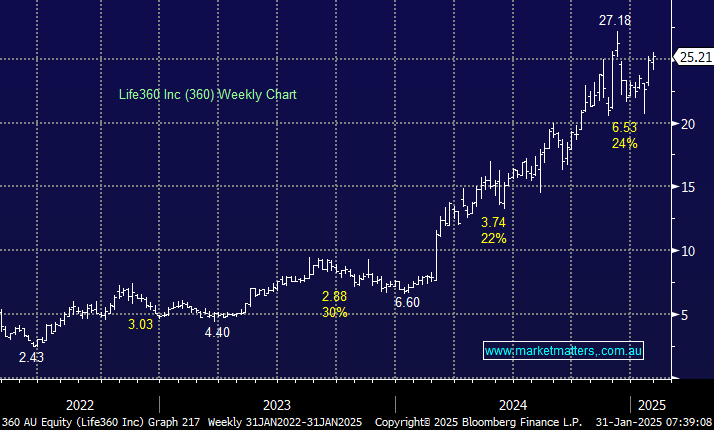

Family location-sharing company Life360 corrected 24% after it announced that CEO Chris Hulls had sold down a portion of his shareholding in late December. In hindsight, we were too fussy, focusing on the average result in late 2024; the sell-down doesn’t worry us as he has plenty of skin in the game and has previously announced plans to sell down his position slowly. Life360 reported solid revenue growth for Q3 2024, but it wasn’t enough at the time for a bullish market:

- Total Q3 revenue of $US92.9 million, up 18% year over year, with subscription revenue growing 27% to $US71.8 million.

- Monthly Active Users (MAU) reached a record 76.9 million, with 6.3 million new users added in the quarter, up +32% year over year

- They added 159,000 new Paying Circles globally, up 35% growth, which helped deliver a net profit of $7.7 million for the quarter, up by nearly $5 million from this time last year

This is a classic dichotomy of valuing growth over current earnings, with today’s profit not relating to the company’s $5.6bn valuation. The company achieved several milestones this quarter, including a partnership with ride-sharing company Uber for location-based advertising. However,

Analysts covering Life360’s US listing expected more in Q3, with the company missing estimates, hence the sell-off. We are fans of 360, but we are cognisant that the stock throws up 20% corrections more often than Christmas comes around.

- We like 360 back in the $20 region, where it was trading in December.