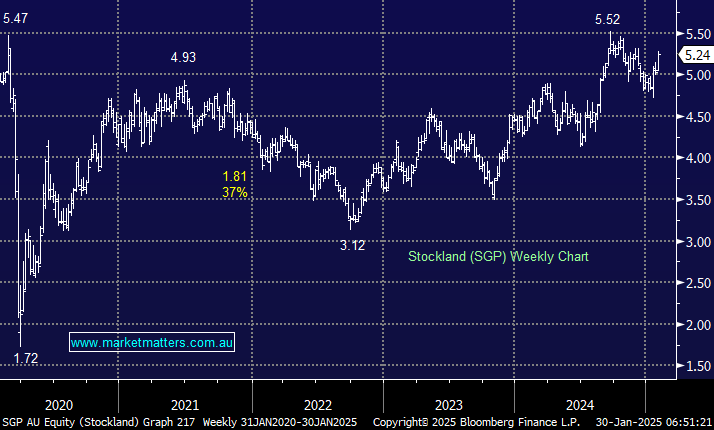

Property is one of the first sectors that investors consider when interest rates fall, which makes sense as the family home often goes up in value, all else being equal. This morning, we’ve deliberately looked at a stock not in an MM portfolio if subscribers are considering increasing sector exposure, SGP is forecast to yield ~6% unfranked over the coming 12-months. SGP is one of Australia’s largest diversified real estate investment groups, which develops, owns, and manages a wide range of properties across the residential, commercial, and retail sectors, all of which should benefit from a lower interest rate environment.

We are conscious of the high expectations after recent strength and optimistic investor expectations around the potential for interest rate cuts to flow through to improved sales/growth. SGP remains the market’s preferred “residential recovery” play with low gearing and capital partnerships in place, and as the saying goes, if it’s not broken, don’t fix it. In line with our market view through 2025, we see limited downside for SGP while a solid yield remains on offer.

- We can see SGP testing $6 in 2025, helped by the tailwind of lower interest rates.