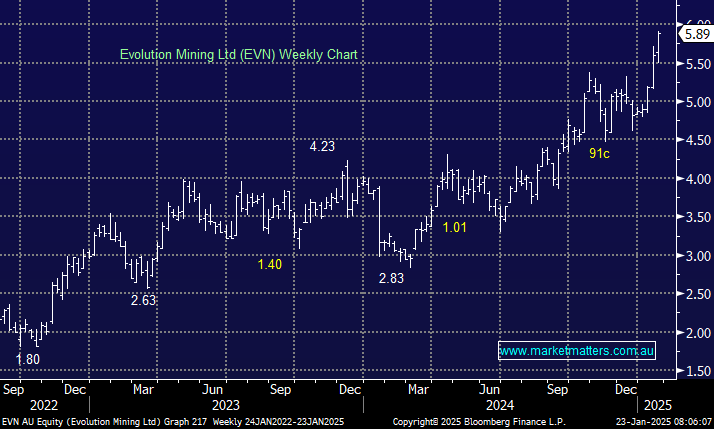

EVN impressed this week delivering record quarterly cashflows helped by a sector-leading All-In-Sustaining-Cost (AISC) of A$1,543/oz. We are big fans of EVN medium-term and we will need a rich price to consider taking profit from our position, although never say never – the stock has corrected 15-30% on three occasions in less than 18-months illustrating how it and the sector can be volatile. We will adopt an if in doubt stay long approach to EVN but if its trading say above $6.50 if/when gold tests $US3,000 we will be tempted to take a more active stance.

- We can see EVN trading well above $6 before its next meaningful pullback: MM is long EVN in its Active Growth Portfolio.

NB: Several broker downgrades this morning may have an impact today.