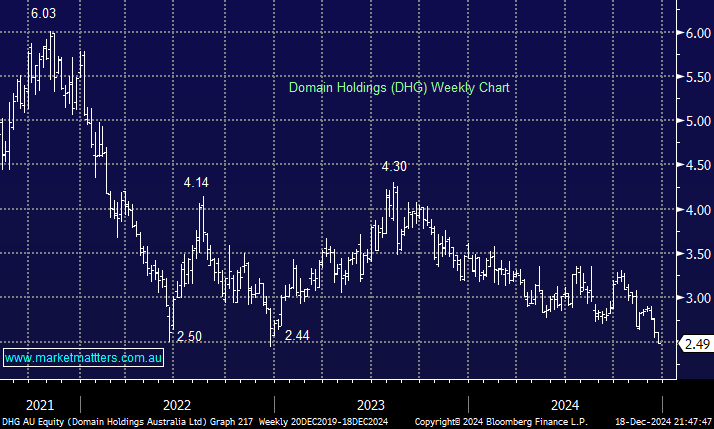

DHG has retreated 28% in 2024, while REA is up +34% over the same period, a good example of the winner taking all (or at least most) in platforms. The stock suffered in November after 1Q25 digital revenue only grew 9% YoY, well below expectations for growth closer to 15%. With the Australian property market softening into Christmas under the weight of cost-of-living pressures and high interest rates, it may be left to the RBA to improve the company’s fortunes. With a forecasted yield of around 2.4% in the coming years, capital growth is required to consider DHG, and we’re not confident on that front.

- We prefer Zillow (ZG US) and REA Group (REA) locally even though both have run hard – MM owns Zillow (ZG US) in our International Equities Portfolio.