QUB is a national provider of logistics and transport services to Australian import-export supply chains; perhaps its most well-known brand is stevedoring operator Patrick (co owned with Brookfield). With a market capitalisation of $6.8bn, QUB is not a classic infrastructure stock per se, and investors often overlook it, but it was a standout performer in 2024, advancing almost 19%. Conversely, most of its sector peers, who deliver a much higher yield, have struggled in 2025 – QUB is forecast to yield around 3% ff over the coming years.

QUB delivered a strong financial performance in FY24, reporting significant growth across key metrics: revenue up 17% YoY to $3.36bn producing $534m in EBITDA. The company and stock look good into 2025/6, with consensus expecting ~14% top line growth in FY25 underpinning a 17% increasing in earnings which is driving down its PE well below its historical average.

The growth is being underpinned by its subsidiary’s AAT acquisition of Melbourne International RoRo & Automotive Terminal (MIRRAT) for ~$332.5m which QUB expects to be earnings accretive in FY25.

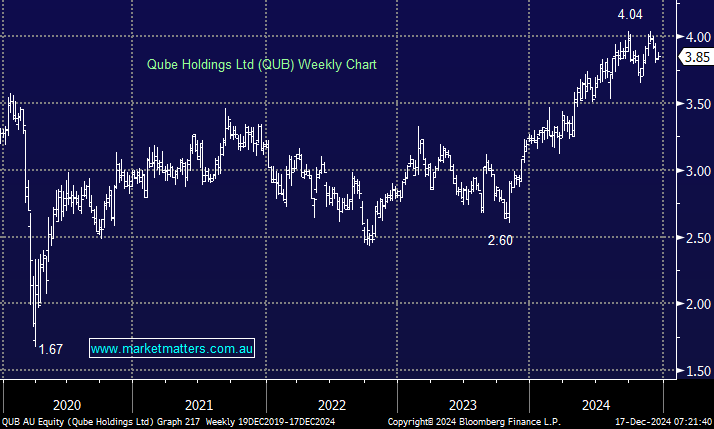

- We like QUB, but further consolidation around the $4 area wouldn’t surprise us.