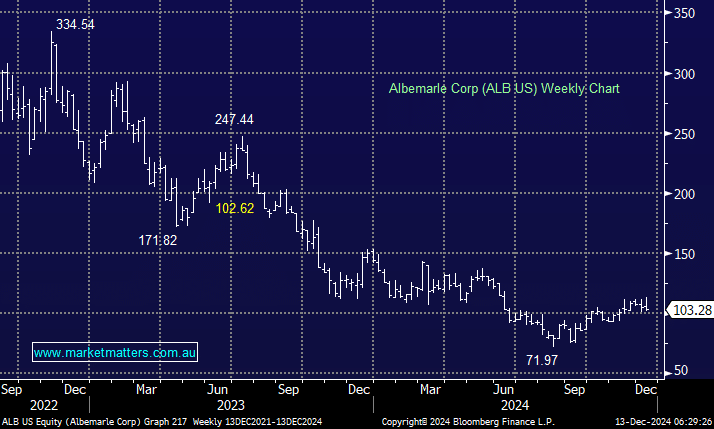

Due to the extremely weak Li price, US lithium goliath ALB has halved production and stopped expansion at its $2 billion lithium hydroxide plant in southwest Western Australia, also writing down the asset’s value by about $1.5 billion. However, In November, the company maintained 2024 guidance for earnings (EBITDA) of $US1.05bn as it continues to strip costs out of operations. ALB is the largest integrated global lithium player, and as it controls costs, it will be well positioned when Li can push back above $US800 – remember, in the last week of November, UBS called the low for Li Spodumene prices.

- We are bullish on ALB, initially targeting a test of the $US130-40 area – MM holds ALB in its International Equities Portfolio.