Weekend Q&A: Volatility continues to surge on the stock & sector level

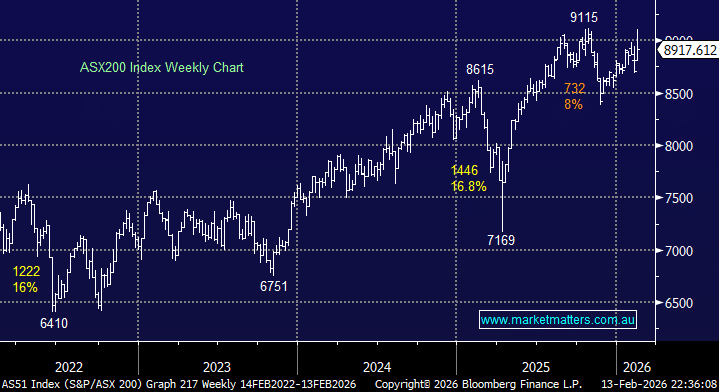

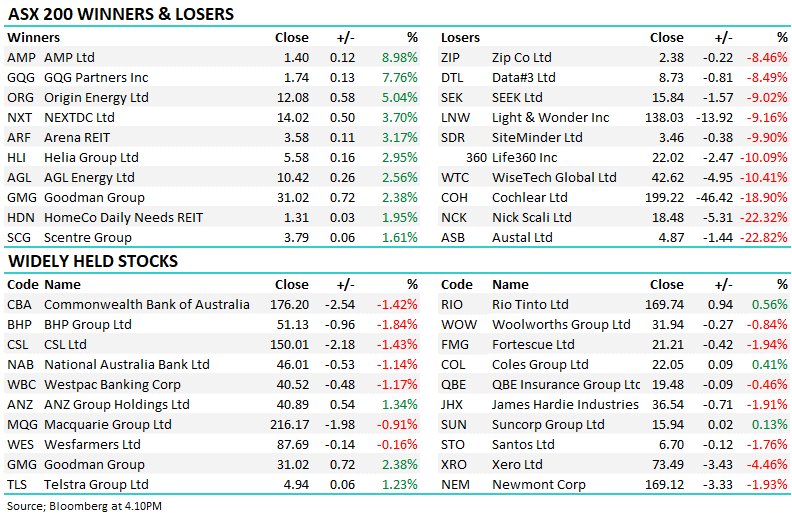

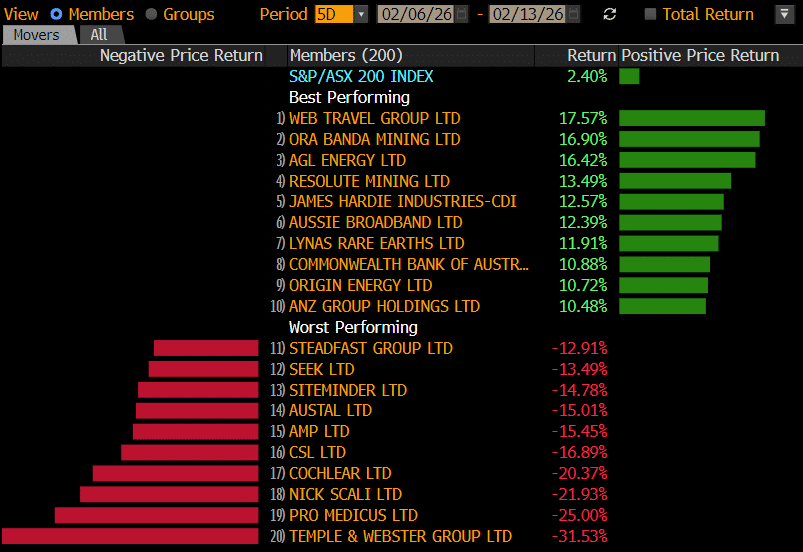

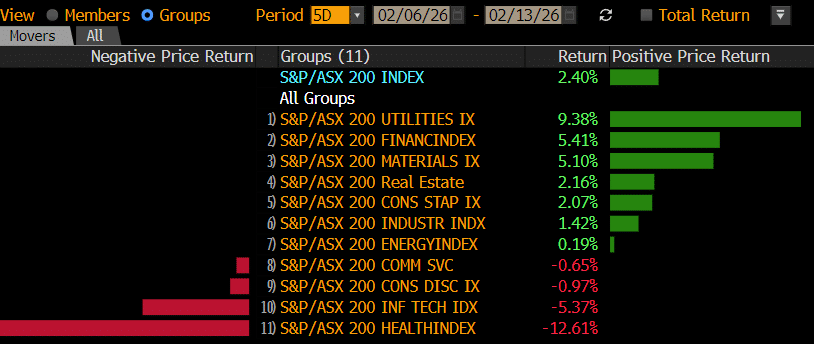

It didn’t feel like it on Friday afternoon as the ASX200 plunged more than 125 points, but the index still managed to finish last week up +2.4% after one of the most violent weeks of reporting season we can remember - 10% swings in either direction were almost pedestrian! The heavyweight banks and resources offset broad market weakness, led by any stocks feared to be at risk of AI disruption, with selling gathering momentum from already panic-like levels. The dominant themes were very binary in nature: