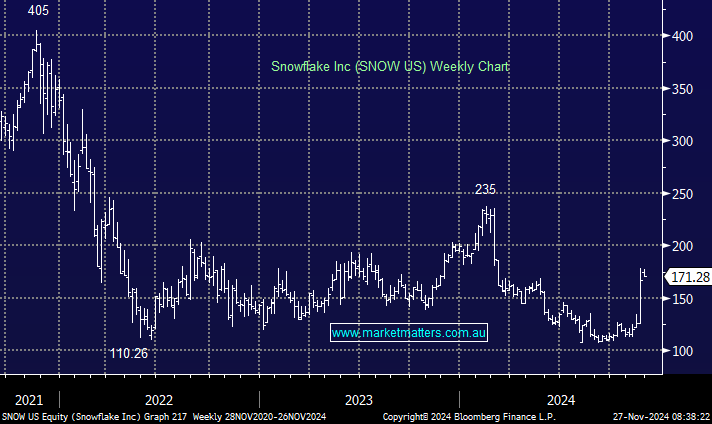

We took a loss on Snowflake around $US113 – near enough to its lows, and the stock has since rallied strongly, as some of our concerns have proved unfounded. At the time of sale, we wrote…”While we believe Snow remains a very strong business, still growing the top line at over 30% driven by increasing demand for data underpinning AI, the challenge for the stock is that the pay-off period on new product launches could be a year or two away. Margins in that time will therefore likely underwhelm, the impact of which is amplified by persistently high interest rates.”

Last week, SNOW reported a significantly stronger Q3 result in the areas that mattered. Top-line growth is very important, but it was not our concern when selling; margins and, therefore, earnings were. To that end, while quarterly revenue of US$942m was light, margins were better, and that drove a decent beat in earnings. We were not alone in our original concerns, hence the big move in the share price and subsequent bullish upgrades from analysts since the update.

- Snowflake is ideally positioned for the next phase of this AI Revolution into 2025 as the number of users increase, creating a deeper pool of potential Snowflake customers.