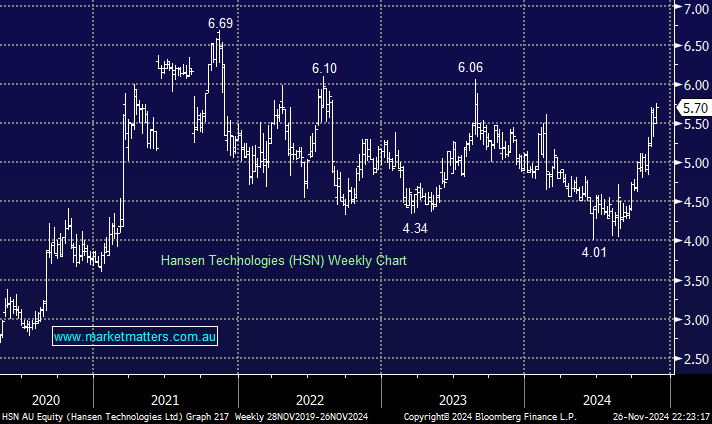

The technology provider that underpins billing for key services like electricity, gas & pay TV has sat on our hitlist for the Emerging Companies Portfolio for some time now, though the share price has been ebbing and flowing between $4 & $6, with no specific catalyst to see it push out of that range. Late last week, HSN held their AGM and provided what we would describe as a positive and comprehensive outlook, and it looks to MM like their German business, Powercloud, is turning the corner. This is the business they bought early this year that was losing ~$30m annually; however, HSN has reduced headcount from 390 to 140, with run-rate cost savings to date of $27m, meaning it will be profitable in the coming months.

- At the AGM, Hansen reiterated its guidance expectations for group revenue of between $398mn-405mn which was ~6% ahead of consensus and cash EBITDA of $76-85mn (consensus $81mn).

We view this update very favourably. HSN is now at a point where it can shift from restructuring and pulling costs out of a new business into growth and take advantage of the significant level of energy company software upgrades from here.