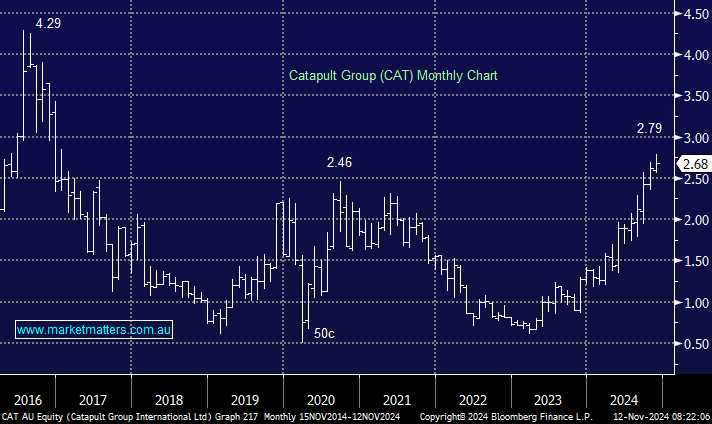

Strong growth in the adoption of a product generally leads to strong earnings growth over time, assuming the product is good and management gets the monetisation strategy right. Sports technology company Catapult is now experiencing growing adoption of their technology, which allows coaches to see how players are performing on the field, and this is translating into strong growth in the financial metrics of the business.

CAT’s most recent contract win was with England’s national and top-tier rugby teams and is important for two reasons;

- It’s the first major deal for both Catapult’s wearable and video products – video has been a slower grind but is starting to work becoming a bigger driver over the coming years.

- CAT unseated a long-term incumbent to win the contract.

Sticky, reoccurring revenue is great and CAT is evolving this income stream successfully. Once a professional sports team starts using Catapult’s technology, they rarely switch it off, with very low churn rates <5%. Top-line revenue growth is running at ~15% ($115m revenue tipped in FY25) and we continue to expect strong growth in earnings and free cash flow over the next 3 years.

- While the stock has had a strong 12 months, the business is growing very nicely, and in MM’s view, has a very good chance of continuing that growth.

The stock enjoyed 57.5% of its revenue from the huge US market in 2024 with further growth projected in 2025. The US market is astronomical and while not directly benefitting from his headline policies, it will enjoy a strong and vibrant US business environment in which to operate.

- We can see CAT making fresh highs well above $4 into 2025 – MM holds CAT in our Emerging Companies Portfolio.