DMP was the market’s worst performer on Tuesday, initially falling over 9% before recovering some of its losses to finish down 6.3% after the fast food chain provided a trading update + announced that chief executive Don Meij would retire after 22 years in the role and almost 40 years with the company after starting in Brisbane as a delivery boy! Compass Group’s Mark van Dyck will succeed him, helped by Meij staying on during a 12-month transition period to work with the board and its incoming CEO. Commenting on his replacement, Meij said: “Mark has been an advisor to the board for the past 12 months, so it was natural we would consider him in the search process. His extensive experience in global food service, combined with a track record of successful transformations, makes him the ideal candidate.”

- DMP’s fall was more due to the company’s soft trading update than the CEO baton change.

- We are 17-weeks into FY25, and same-store sales (SSS) are down 1.2%, with issues remaining in Germany, France and Japan – a poor update with no improvement in sight.

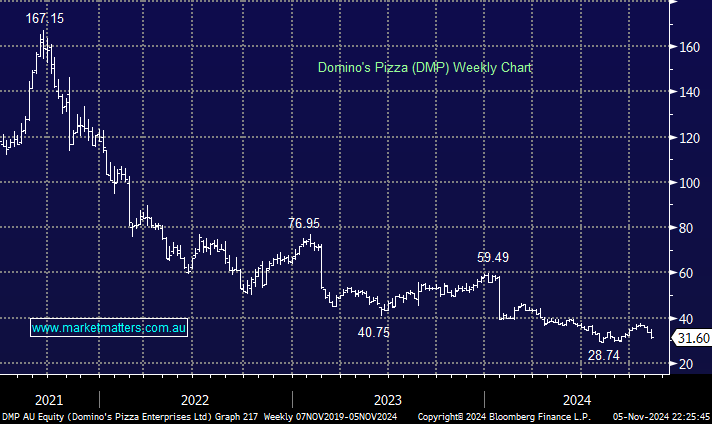

We like the appointment with a company that needs a fresh approach. The incoming CEO’s CV reads extremely well with Compass (CPG LN), a GBP44 bn UK-listed company whose stock has rallied 250% post-COVID, a very different story than DMP’s. MM has avoided DMP for years, but this appointment is fascinating. If we see a classic “clear the decks” style move that sends the stock back under $30, the stock will be interesting as a high-risk/contrarian play.

- DMP is not cheap for the level of growth they are delivering, trading on an Est P/E of 22.4x for FY25. The trend in earnings is the key, more so than the multiple in MM’s view.

- We were neutral to bearish DMP in June; the stock has since fallen ~15%, and we are now neutral, watching for signs of improvement in the business.

DMP’s fall from grace has been painful for many investors, and it provides an excellent illustration that where a stock has previously traded is no indication of what will happen next. At this stage, we would want to see a washout selloff to provide compelling value or an improvement operationally to consider DMP.

- We see no clear risk/reward entry opportunity into DMP here and now, but one may present itself in 2025.

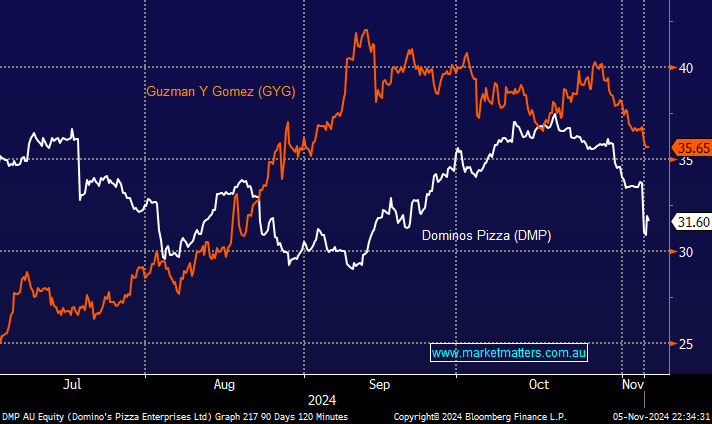

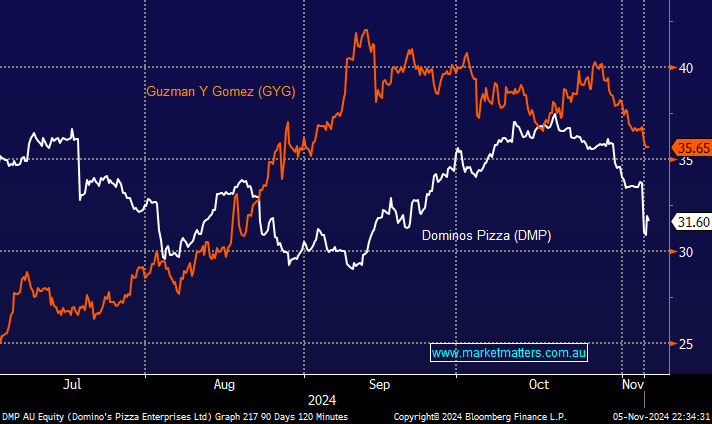

On June 20th, when Guzman Y Gomez enjoyed its much-heralded listing, Dominos was trading at $36, with GYGs first trade on the ASX at $30. Today, GYG has gained ~19% while DMP has fallen ~14%, some significant performance variance within one sector. Our simple question is, do we see value in either of these fast food chains into Christmas?

- DMP has a market cap of $2.9bn and delivered $2.4bn revenue in FY24.

- GYG has a market cap of $3.6bn and delivered $342mn revenue in FY24.

A business is valued using a lot more than just today’s sales, but clearly, the market is very bullish about GYG’s execution in the years ahead. On valuation terms, Goldman recently came out with a “sell Mexican, buy KFC” in junk food terms, or buy Collins Food (CKF) sell Guzman (GYG). We think it’s too early to extrapolate this to buy pizza sell Mexican, but it’s worth watching.

- We aren’t keen on DMP or GYG into Christmas.