How to play the Royal Banking Enquiry

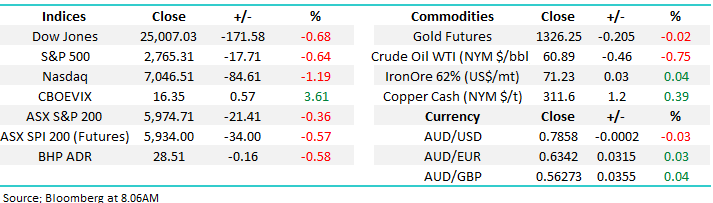

The ASX200 put in another pretty average performance yesterday falling 21-points / 0.4% while the overnight markets were pointing to a small rally. The local market feels like it’s having a pretty poor time on a relative basis as local uncertainty raises its head in a couple of important areas, however the numbers are better than they feel - the Dow is 6% below its all-time / 2018 high whereas the ASX200 is only 2.9% below its 2018 high. Basically we have not joined in with the global euphoric rally by stocks but we feel relatively well insulated during weakness – note the word relative.

1. Labor has announced a cash grab to the tune of $59bn from shareholders who have been enjoying cash refunds for excess dividend imputation credits. Certainly a more popular move than changing negative gearing, even though a number of retirees are in the crosshairs – most likely liberal voters. Unfortunately people regularly feel most politicians seem to spend far more effort attempting to win the next election rather than worrying about the future of Australia, it feels like we are about to receive a plethora of tax offers / cuts / announcements etc from both parties as they juggle for the votes – clear uncertainty with the first salvo by Labor a negative for equities on first take, however there are some potential offsets – a topic we’ll cover more in today’s income report.

2. Bank bashing is again dominating the press as the Royal Banking Enquiry gets underway, I find this frustrating at times. The US saw 465 banks close their doors courtesy of the GFC, while one of the main reasons Australia avoided a recession during the GFC was the strength and stability of our banks. Bank bashing simply sells more papers and wins more votes and while undoubtedly the banks need to clean up their act in a number of different areas it feels that “putting them on the stand” is a touch harsh, especially as it indirectly hurts virtually all Australians via our Super.

Just compare what the US has given their market / banks compared to us – a decreased onerous / expensive regulatory environment and tax cuts - perhaps as is often the case somewhere in between the two would be ideal.

The ASX200 is set to open down 40-points / 0.7% this morning and we will turn neutral from short-term bullish if the ASX200 cannot close above 5950 minimum. Today’s report not surprisingly is going to focus on the banking sector as the Banking Enquiry kicks into gear.

ASX200 Chart

After propelling US equities to fresh all-time highs courtesy of regulatory relaxation and tax cuts its feels like Trump has finally gone short equities! The controversial US President is throwing obstacles at the US market at every turn:

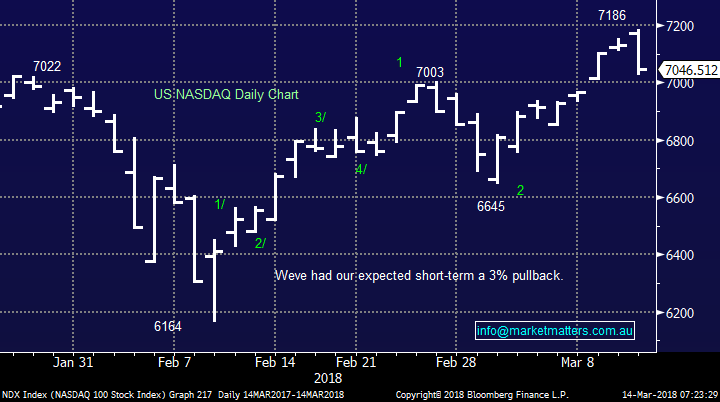

- Yesterday he blocked the Qualcomm-Broadcom chip deal sending the tech based NASDAQ down -1.2% after it reached fresh all-time highs early on in the day.

- Trump also just fired his secretary of state, Rex Tillerson, causing further market unrest around the stability of his government.

- We’ve only just recovered from his aggressive introduction of steel and aluminium tariffs sparking global concerns around a trade war.

Overnight the tech leading NASDAQ index closed -1.9% below its intra-day high and we will lose our short-term bullish outlook on a close beneath the psychological 7000 area.

US NASDAQ Chart

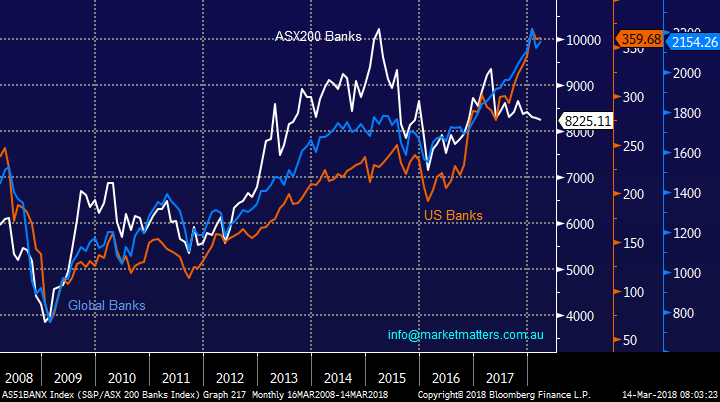

Australian Banks & the royal enquiry

The local banks have recently had the proverbial kitchen sink thrown at them e.g. Royal Commission, bank levies, APRA almost ending the supply of investor apartment buyers, Chinese investors being deterred from all angles, Austrac and of course they are being made to hold more capital by regulators.

The main issue with our banks on a performance basis really kicked into gear in May 2017, the comparative numbers are very noticeable:

- Since May 2017 the ASX200 banks are down -12.4% while US banks are up 30.5% and global banks are up 19.4%.

Assuming we do not get a major correction / collapse of the Australian housing market we feel this period of underperformance should be coming to an end i.e. the elastic bank has become very stretched.

Australian Banks v Global Banks

The many problems that have been thrown at our banks are pretty well known, plus there is undoubtedly a degree of a correction within our housing market also built into their price, however while employment and GDP remains strong it feels to us that the banks are being dealt with a touch harshly.

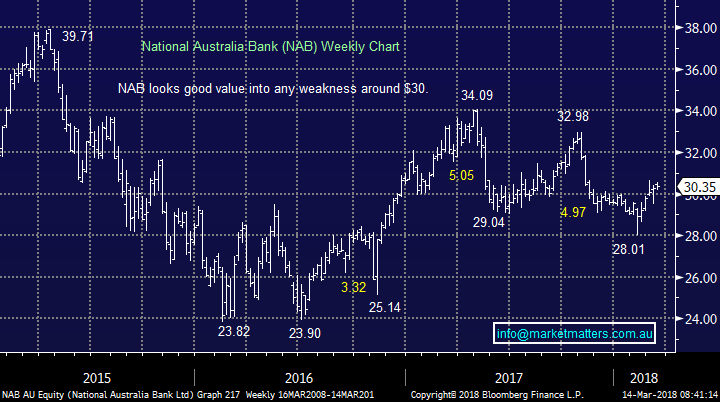

MM acknowledges the banks are struggling to grow by more than a few percent but to us they have become a pretty good annuity / yield play with relatively low risk e.g. at yesterdays close NAB is yielding 6.52% fully franked. We feel at some stage down the track they will be repriced and rally fairly sharply, a great sign of this would be a piece of negative news coming out of the Banking Royal Commission that bank stocks shrug off i.e. they don’t fall on perceived bad news. The other opportunity for our banks is reducing their cost base, we believe that will be the theme moving forward as we saw recently with NAB retrenchments.

Also assuming interest rates are going to rise in Australia moving forward this theoretically is bullish for bank profits, as long as rates do not rise too fast causing distress to borrowers which obviously leads to increased bad debts for the sector. It’s easy to be worried about the Australian Banking Sector if you read todays press but as we said the news is on the table and when we look at value this picture becomes pretty rosy. US banks have rallied strongly on the double positive whammy of rising interest rates and reduced regulatory environment…..perhaps we could be there next year on both fronts, when compared to today, after the Royal Commission concludes in 2019, remember markets look over 6-months ahead.

Value – Local banks are cheaper than US banks which is almost unheard of, especially considering how they’ve been strengthened over recent years.

The problem for them is the final outcome of the current Royal Commission will be well into 2019, leaving a lot of water to go under the bridge implying some excellent buying / selling opportunities during the next year – ideal for active investors. They feel a bit like Telstra but with more clarity i.e. attractive fully franked dividends on offer for those that can buy at good levels.

Lastly on the Royal Commission the ultimate goal is to improve the transparency / health of the Banking Sector and as this filters through, the stocks should come into favour, it’s just a matter of when.

Overall we believe that local banks are in an accumulate phase or for more active investors like ourselves an extremely exciting time.

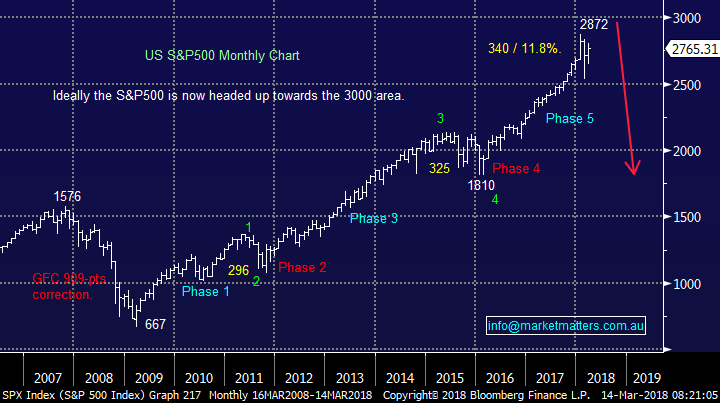

Subscribers should remember we are looking for a ~20% correction to US stocks over the next few years which should provide excellent opportunities to get exciting exposure to our banks e.g. NAB yields 6.52% fully franked now, if it corrects only 10% from yesterdays close it will be yielding over 7.3%.

US S&P500 Chart

Overall we don’t think there is a great deal between the “big 4” banks at present although were not particularly keen on the second tier components of the sector.

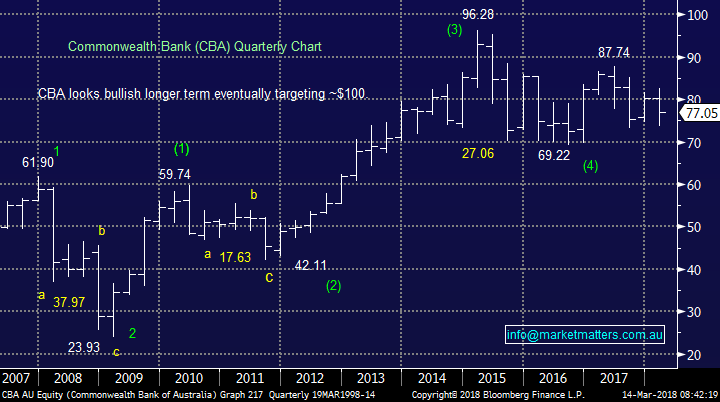

CBA and NAB look best technically while the valuation gap has opened up for Westpac, with WBC now the cheapest of the big 4. Buying the negative news helps with good price location and there has clearly been some of this particularly with CBA this year.

National Australia Bank (NAB) Chart

Commonwealth Bank (CBA) Chart

Conclusion

- We are comfortable with our banks at current levels but obviously expect significant volatility within the sector if the US market is close to a +20% correction, hence our preference is the more active approach i.e. sell strength buy weakness as +10% swings are common within the sector.

- We believe that Australian banks will outperform their global piers over the next 2-3 years.

Global markets

US Indices

No major change, overall we believe US stocks have formed a low and they will be higher in 1-2 months’ time, although Trump is trying to derail our view.

- While we expect US stocks to rally to fresh highs the likely manner of the advance is far more choppy / indecisive than the almost exponential gains we have witnessed from late 2016 – feels accurate at the moment.

US Dow Jones Chart

European Stocks

European indices have been lagging since late January but picked up over the last 48-hours, potentially we’ve seen their low for a few months.

German DAX Chart

Asian Stocks / Emerging Markets

We remain bullish Asia at current levels ideally targeting fresh 2018 highs in the next ~4-6 weeks – ideally the highly correlated Emerging markets Indices will trade in a similar manner, we are targeting ~10% gains.

Emerging Markets Chart

Overnight Market Matters Wrap

· Uncertainty continues to linger in the US markets following President Trump’s dramas with his political team and reshuffle, overnight was the sudden firing of US Secretary of State, Rex Tillerson.

· On the commodities front, the energy sector weighed, courtesy of crude oil’s slide as investors anticipate lower global demand vs its current inventory.

· BHP is expected to underperform the broader market today, following its US session ending an equivalent of -0.58% to $28.51 from Australia’s previous close.

· The March SPI Futures indicating the ASX 200 to open 40 points lower towards the 5935 area this morning.

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 14/03/2018. 8.13AM

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here