Lithium stocks explode out of the blocks (GXY, KDR, ORE)

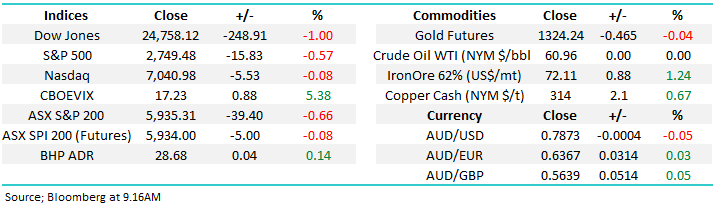

The ASX200 looks set to open essentially unchanged this morning ignoring another weak night on Wall Street where the Dow fell 248-points, although we noticed the NASDAQ closed more or less unchanged. Interestingly it was fairly weak retail sales data that was blamed for the selling yet this would imply inflation will remain low and interest rates will not rise too fast which was the markets major concern during Februarys rout.

· In our opinion US stocks feel like they are slowly changing their tune as they embrace potential market negatives daily as opposed interpreting it as good news.

We’ve been looking for US stocks to experience choppy consolidation around current levels before pushing to fresh highs into May and this is undoubtedly what the market is giving us at present. It’s very important for us to clarify our investing position moving forward:

· MM is currently a seller of strength in stocks, not a buyer of weakness.

Following yesterday’s close by the ASX200 below 5950 we are now short-term neutral local stocks needing a close back above 6030 to switch us bullish.

This morning the March futures / options expire, which we’ve touched on a few times, it’s likely we will get a better handle to the underlying strength or otherwise of the local market over the next 48-hours.

Today’s report focuses on the lithium space for the second time this month following huge gains in the sector yesterday with our profit target rapidly looming for Kidman Resources (KDR).

Active investing / trading is simply about sensible and evaluated risk / reward, investors don’t need to play in “penny dreadfuls” for the chance of relatively quick gains – our KDR is already up over 17% since late January.

ASX200 Chart

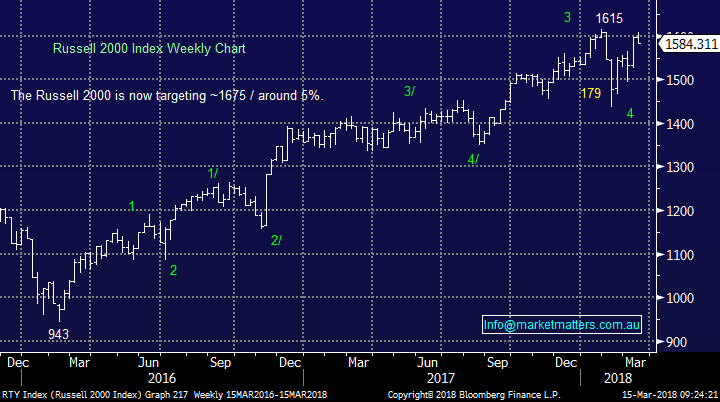

Overnight the strongest US indexes that MM evaluates closely, the NASDAQ and Russell 2000, both closed only marginally lower and look fairly well positioned for fresh all-time highs moving forward – the smaller cap Russell 2000 is still less than 2% below Januarys all-time high.

US Russell 2000 Index Chart

Lithium Sector

Yesterday the Australian lithium sector charged ahead living up to its reputation as an extremely volatile place to invest – unlike the market itself this is one area we will consider buying into weakness.

The breakout in the sector was huge with Kidman Resources (KDR) +9%, Orocobre (ORE) +5.6% and relative underperformer Galaxy Resources (GXY) +9.1% - it felt like a major overseas fund manager simply pressed the sector buy button.

Back on the 29th of January we switched our ORE holding to KDR which has happily added over 30% in relative performance in just a few weeks, this is a great example of what MM is attempting to achieve:

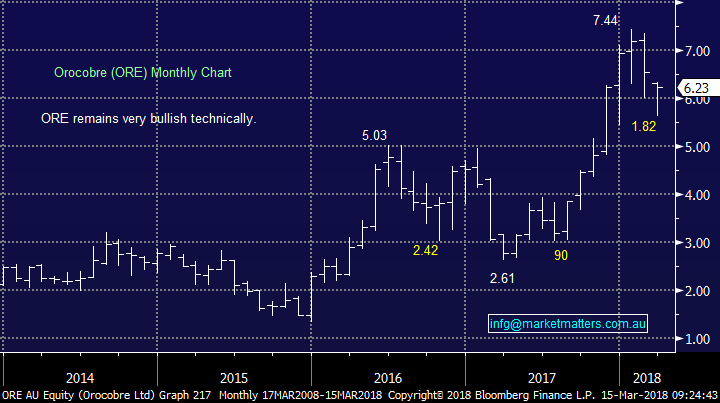

1. We sold ORE on 29/1 at $7.27 for a ~15% profit – yesterday the stock closed at $6.23, -14.3% below our exit.

2. At the same time, we bought KDR at $1.87 – yesterday the stock closed at $2.19, up +17.1%.

I reiterate that this is a sector that MM likes and will consider buying weakness if /when it unfolds however we will also be a happy seller into strength - remember this is undoubtedly an extremely volatile sector.

An example of the longevity of the sector was again confirmed whenGSR Capital, the Chinese private-equity firm who bought Motor Co.’s battery-making business, announced plans to invest $500 million in National Electric Vehicle Sweden AB, plus it intends to build a battery factory in Sweden.

However, while we are firm believers in the growth of electric batteries moving forward we have to also consider how much perceived future growth is already built into the respective stock prices with sector heavyweight ORE trading on 35x estimated 2018 earnings. We believe the current advance by the Australian lithium producers is fairly mature.

Let’s take a quick glance at the 3 main Australian lithium players that MM watches.

1 Orocobre (ORE) $6.23.

In January ORE raised capital for some exciting expansion with Toyota taking the bulk of the raising spending almost $300m for 15% of ORE at $7.50 per share. Toyota are clearly looking at the huge potential increase in demand for lithium as cars take the Tesla lead and turn electric.

Depending on the relative moves between KDR and ORE moving forward we may switch back to ORE, from KDR.

We remain bullish ORE and can see a test of $8 moving forward.

Orocobre (ORE) Chart

2 Kidman Resources (KDR) $2.19

KDR has recently been our favourite stock in the lithium / car battery space, it looks likely to be the largest Australian lithium producer in time plus its costs are at the low end of the sector. KDR also enjoys an experienced major partner in Chilean producer SQM that should offer strong support if / when required KDR has enjoyed a strong 9-months along with most of the sector, we believe it’s now time to sell strength and buy weakness.

We are long KDR from $1.87 and remain bullish with a +$2.25 target.

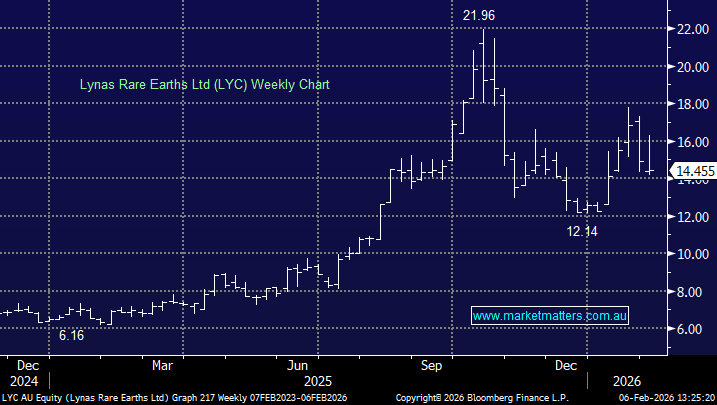

Kidman Resources (KDR) Chart

3 Galaxy Resources (GXY) $3.49

GXY has been the more volatile stock in the sector as we witnessed yesterday with its +9.1% appreciation but it’s remains -23% below its 2018 high.

We’re happy to avoid the volatility with GXY and focus on ORE and KDR.

Galaxy Resources (GXY) Chart

Conclusion (s)

We are likely to be active in the lithium sector moving forward:

1. We are looking to take profit on KDR between $2.25 and $2.30.

2. We may consider switching back into ORE depending on the relative performance at the time.

Global Indices

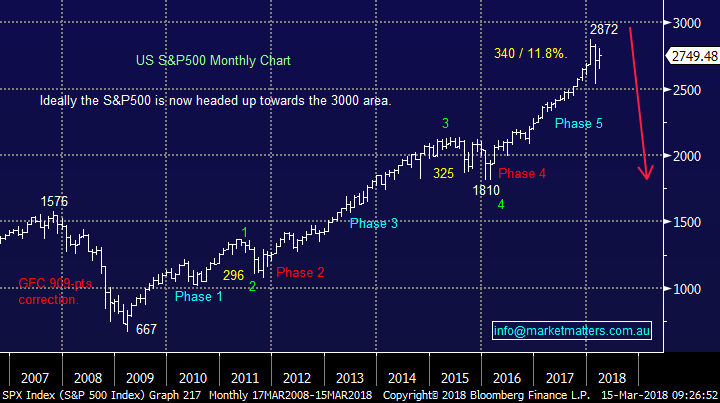

US Stocks

The US market is currently very choppy and while ideally we are still looking for fresh all-time highs moving forward we are becoming increasingly aware of our longer-term call for a +20 correction starting this year.

US Dow Chart

US S&P500 Chart

European Stocks

No major change we are now targeting around the 14,000-area for the German DAX before we will turn bearish.

German DAX Chart

Asian Stocks

Similarly, to western global indices the Asian markets / EEM corrected over 10% and now look good from a risk / reward perspective for fresh highs in 2018 - the more time the market can spend around 49 the stronger it will look technically to us.

Emerging Markets (EEM) ETF Chart

Overnight Market Matters Wrap

· Signs of weakness in US consumer spending and an oversupply of oil saw the US indices close in negative territory.

· Metals on the LME were mixed, oil was +0.1%, gold was slightly stronger acting as a safe haven against the market and iron ore recovered earlier week losses closing +2.7% at $US71.64/t.

· The June SPI Futures is indicating the ASX 200 to open 5 points lower towards the 5930 level this morning. Note it is March Index expiry this morning and expect some volatility.

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 15/03/2018. 8.13AM

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here