Hi Josh,

We were in a presentation with Charter Hall yesterday about the office space and while they’re talking their book to some degree, they do see tangible signs that things have turned. The share prices of the listed players like Dexus (DXS) & Charter Hall (CHC) have started to factor the turnaround in, underpinned by a greater level of transaction activity, particularly from overseas investors buying Aussie office assets. We sit in Chifley Tower in the Sydney CBD, and there is a new $1.4bn tower coming up next to us. The lead times here are very long, so long term modeling is very important, and with less supply and the usual drivers, they see strong demand for A grade office, but very weak demand persisting for lower quality buildings, and with high construction costs, these sorts of assets remain very challenging. WFH is largely done, with most large employers now insisting on 3-days per week min, BHP this week set 4-days min.

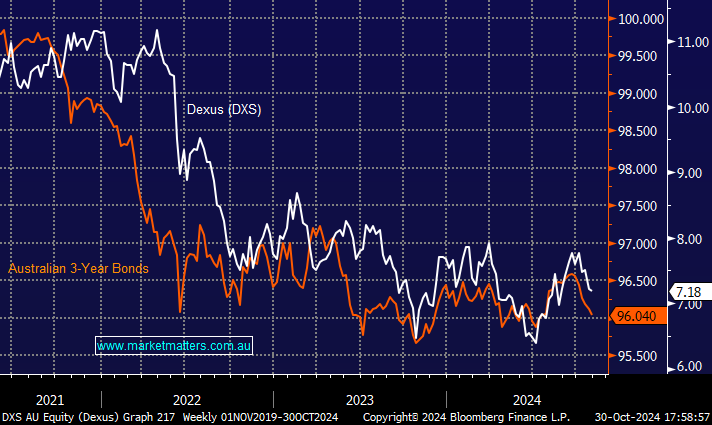

DXS has high quality A-Grade buildings, and we like them for that reason. We have considered DXS again for the income portfolio, though, some of the above turnaround is now in the price. The correlation between Australian 3-year bonds and DXS is close to perfect and until Michele Bullock et al turn more dovish it’s hard to see DXS moving out its $6-8 trading range.

However, MM believes bonds will ultimately rally from current levels, yields lower. Hence, with DXS forecast to yield around 7% over the coming years we believe the stock looks good around $7.