Hi Alex,

We read these sorts of reports and many more alike, but we describe ourselves as Active Investors and it’s hard to overlay a 10-year view over say the next 3-6 months. The two most important points are we are long term believers in equities and whatever the market does on the index level there will be plenty of winners & losers on the company level. So far in 2024, as of Wednesday, there are 27 stocks up over 40% and 9 down by the same degree, while the ASX200 is up +8.2% hence the larger number of winners:

Winners: Judo Capital (JDO) +86%, Westpac (WBC) +40%, Ventia (VNT) +48%, JB Hi-Fi (JBH) +50%, Aristocrat (ALL) +42%, Goodman Group (GMG) +43%, Zip (ZIP) +344%, HMC Capital (HMC) +48%, HUB 24 (HUB) +87%, Netwealth (NWL) +80%, AMP Ltd (AMP) +56%, Pinnacle (PNI) +56%, Bega Cheese (BGA) +51%, Pro Medicus (PME) +96%, Sigma Health (SIG) +84% , Fisher & Paykel (FPH) +54%, Perseus Mining (PRU) +58%, Westgold (WGX) +51%, Emerald Resources (EMR) +45%, Sandfire (SFR) +46%, Ramelius (RMS) +47%, West African Resources (WAF) +82%, Telix (TLX) +109%, Technology One (TNE) +59%, Life360 (360) +193%, Codan (CDA) +86%, and Qantas (QAN) +41%.

Losers: Tabcorp (TAH) -44%, Star Entertainment (SGR) -49%, IGO Ltd (IGO) -42%, Liontown (LTR) -48%, Mineral Resources (MIN) -46%, Lifestyle Communities (LIC) -50%, Audinate (AD8) -45%, Spark NZ (SPK) -44%, and Kelsian (KLS) -41%.

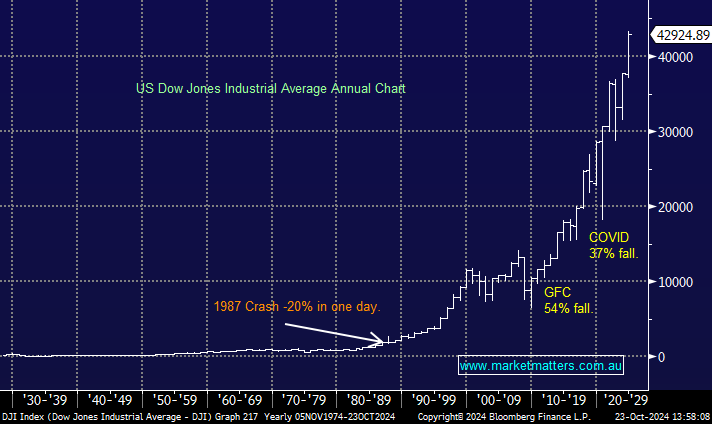

Ultimately, we think making bold calls like that is more about marketing than anything else. It’s a well-trodden path, a bit like the predictions of where the market will be at the end of each year – i.e. they are often wrong. So much can happen in 12-months, let alone 10-years. History tells us equities go up over time, so that’s a good starting point. We then roll with the punches, assess trends daily/weekly, keep our finger on the pulse, and make decisions.