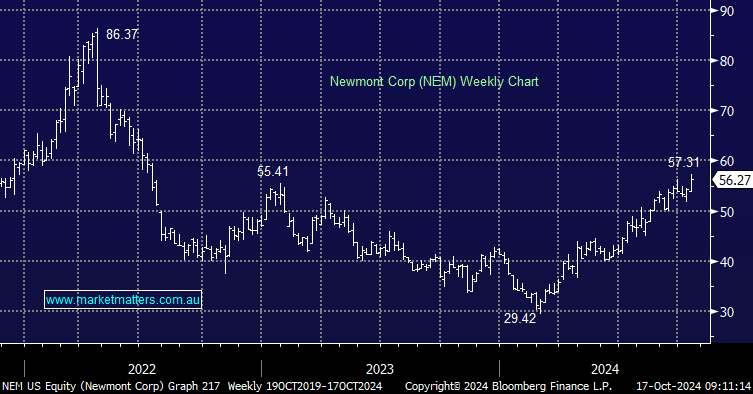

NEM is the world’s largest gold producer both in terms of market cap and output, helped by last year’s $26bn merger with long-time local favourite Newcrest (NCM). NEM has almost doubled from this year’s low, which is no mean feat for a $US64bn company, although the gold price has afforded it a huge tailwind. The company delivered some impressive FY24 numbers, although their All In Sustaining Cost (AISC) of $US1500 is notably well above EVN. However, the sheer scale of the business is impressive; in July, NEM announced a solid second quarter, producing 2.1 million Oz of gold and generating $US594 million in free cash flow, which allowed them to complete $US250 million in share repurchases and repay $US250 million in debt.

- We like NEM but wouldn’t be surprised to see it consolidate in the $US55-60 region before pushing higher.